TOP 3 TL;DR

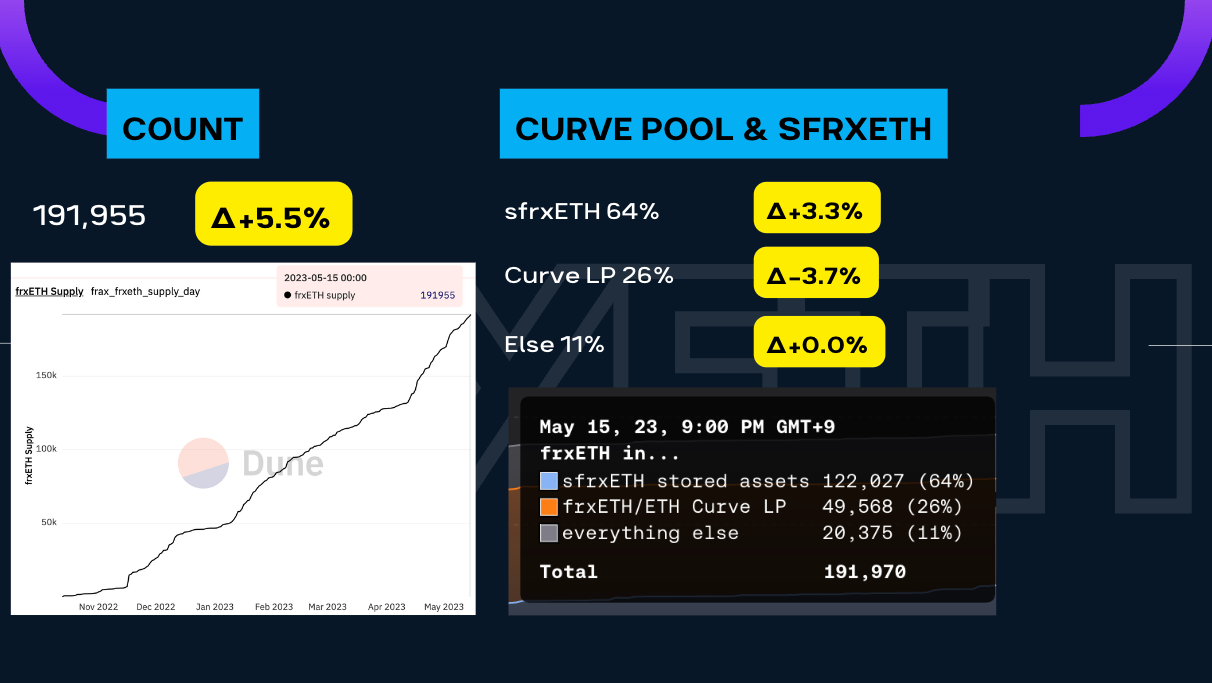

- frxETH // Supply 191,955 ∆ +5.5%

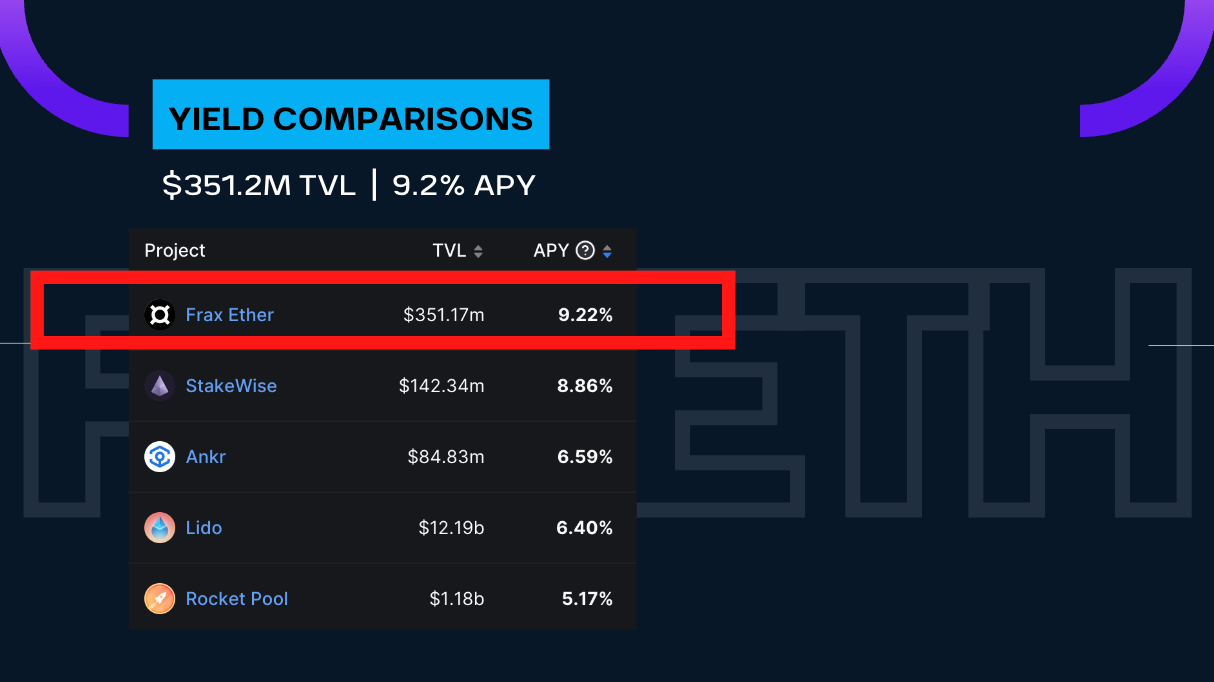

- frxETH // 9.2% APY

- FraxLend // Liquidations $15.5k

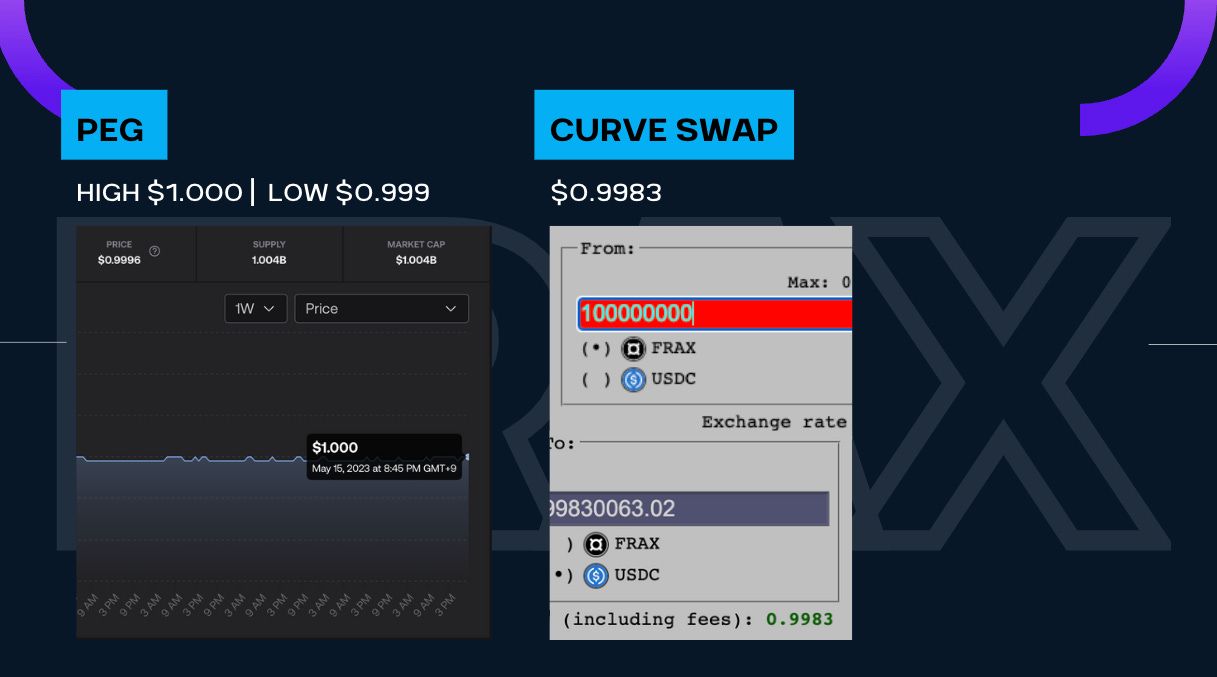

Frax Supply & Peg

This week things are quiet in the $FRAX realm. We have supply remaining flat, the peg range is tight, and the Curve swap exchange rate is above average. Not much to report here so let’s move onto the Collateralization and Decentralization Percent.

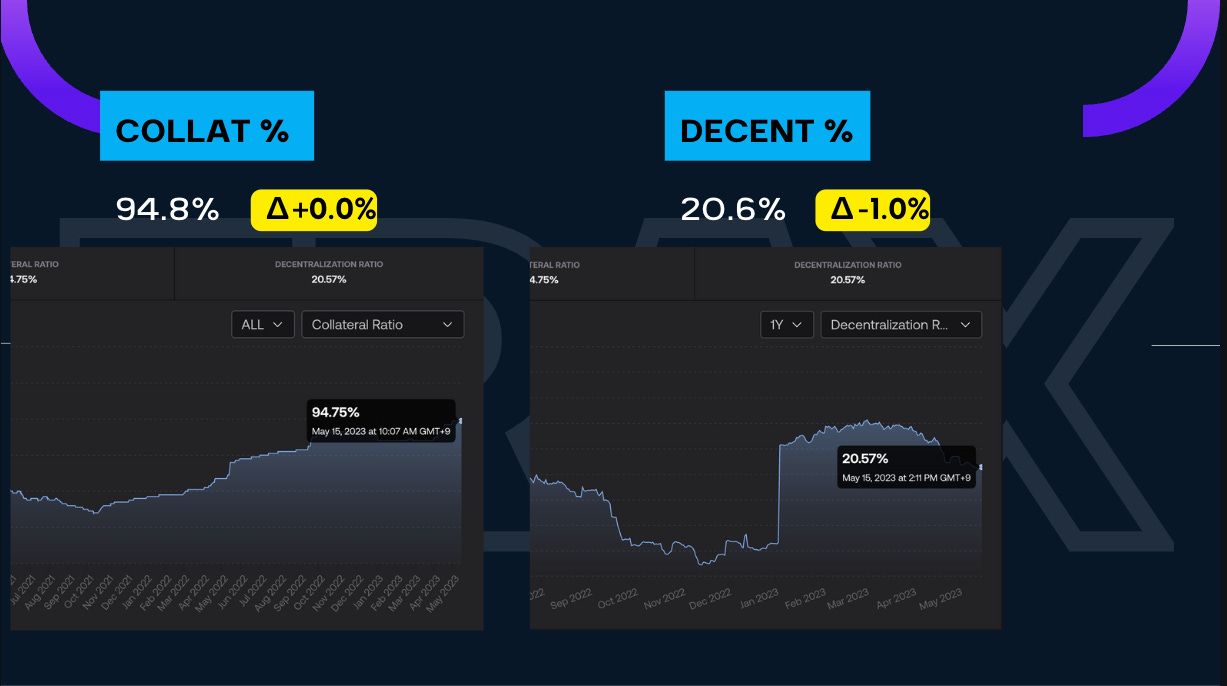

Collateralization & Decentralization Ratios

Again, very calm on this front as well. The Collateralization Percent remains at its all-time-high of 94.8%, been this way for the past 3 to 4 Frax Checks. The Decentralization Percent saw a drop of 1% this week down to 20.6%. We’ve been on a downtrend for nearly 8 weeks now.

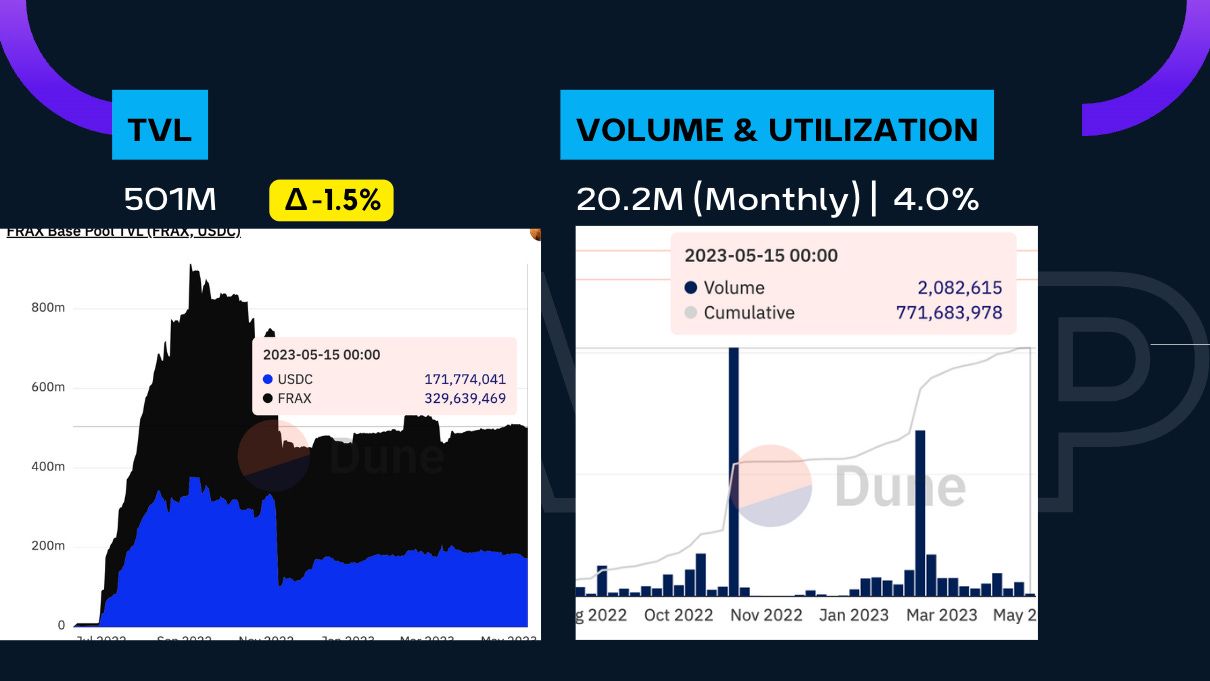

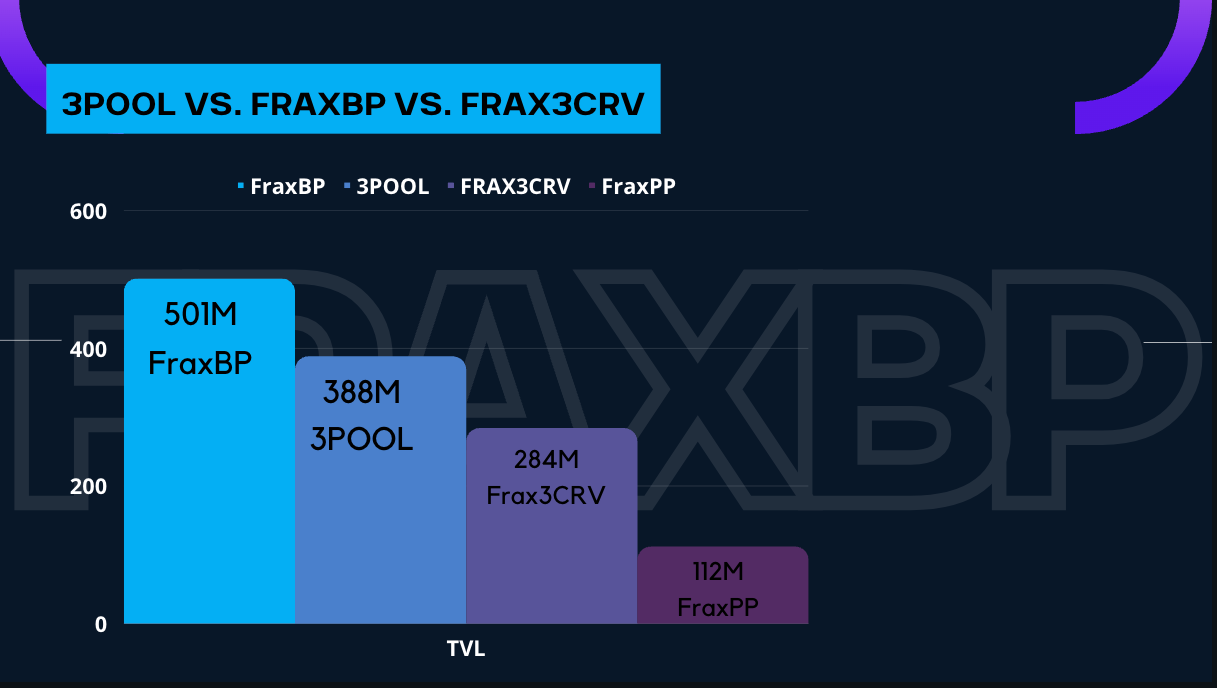

FraxBP

For Frax’s liquidity-as-a-service in the form FraxBP, we have 501M TVL which experienced a 1.5% drop. The volume is at 20.2M so far for May, which is only a 4% utilization rate, fairly low when compared to what happened in March with the USDC fiasco.

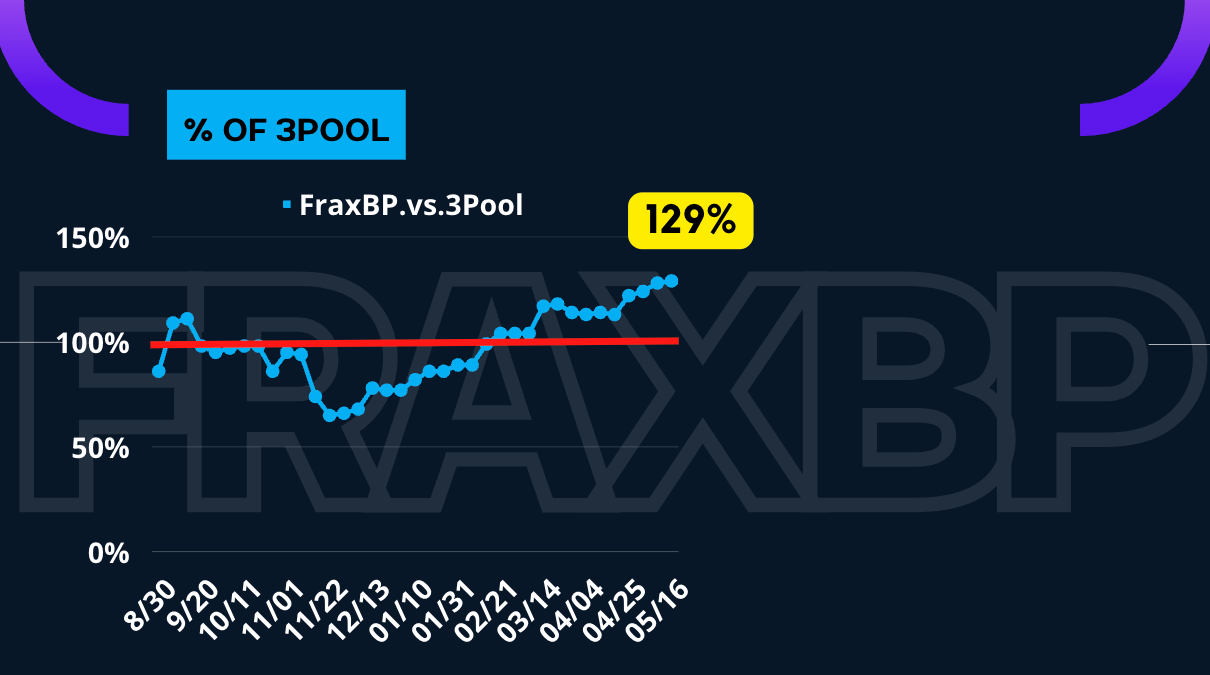

% of 3 pool

We are definitely in a new regime for the % of 3Pool. This marks a significant milestone in the relationship between Frax and Curve as Frax pools are now the predominant stable coin pools on Curve.

Additionally, we have a new contender in the mix approaching from behind. FraxPP entered the scene with a whopping 112M TVL — not too shabby. We see that FraxBP is at 501M, 3Pool at 388M, and Frax3CRV at 284M.

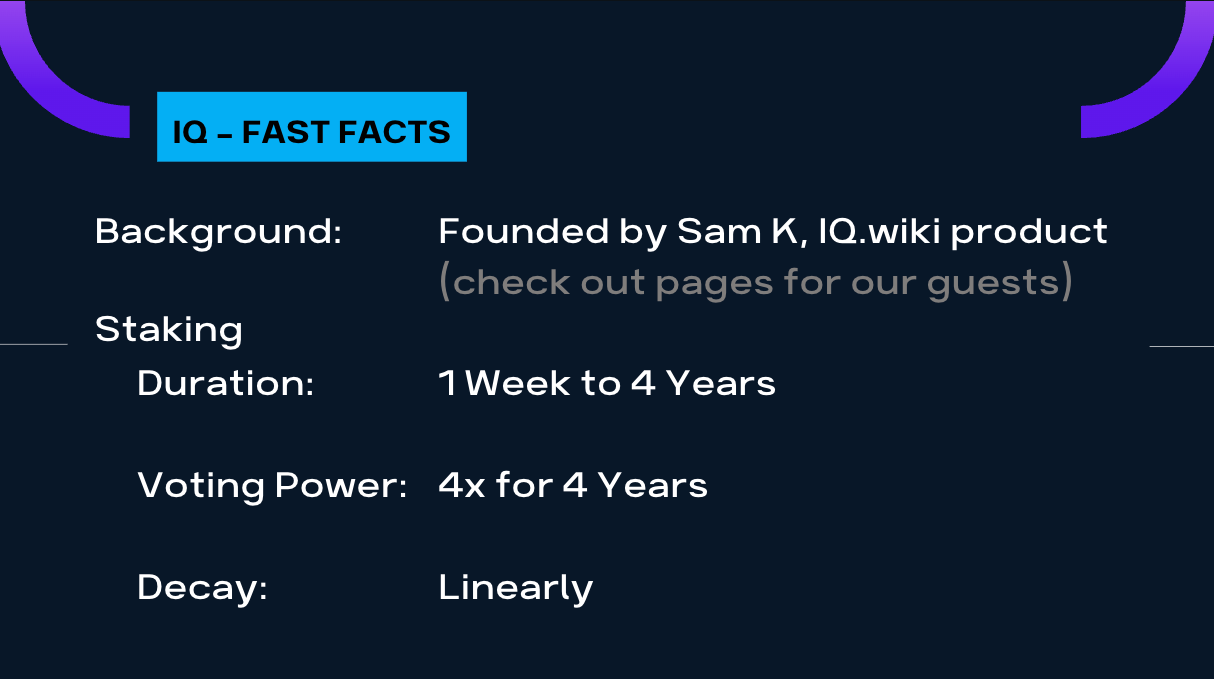

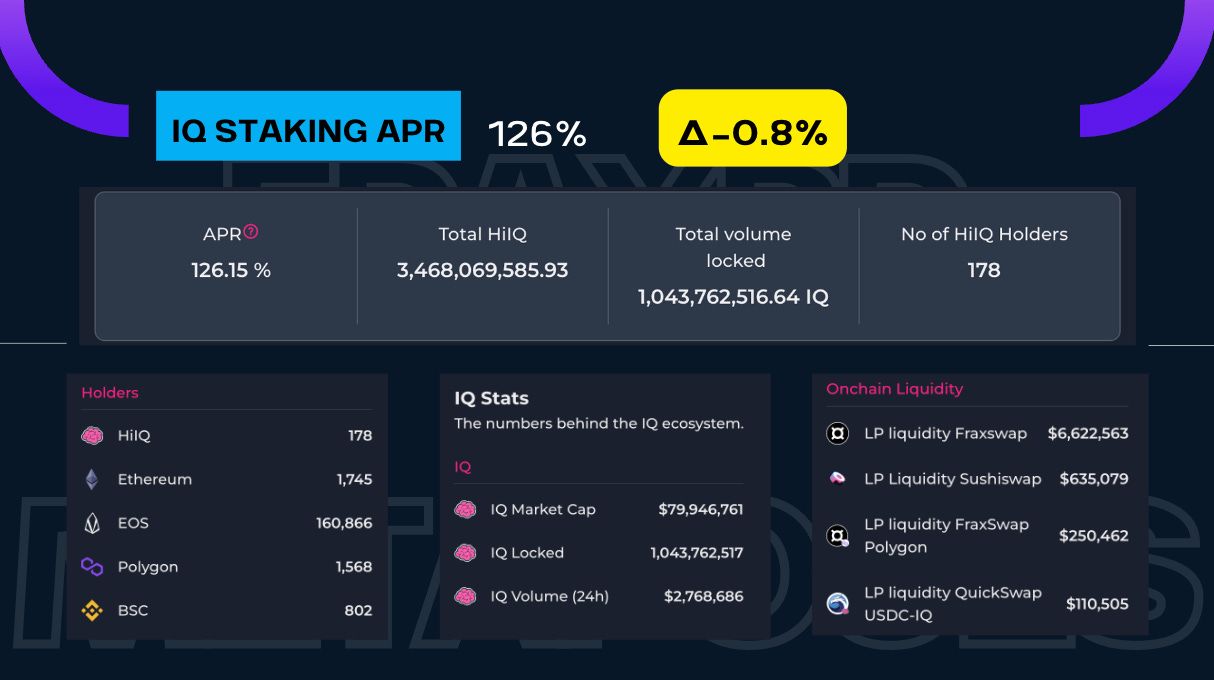

IQ Staking

Did you know that BrainDAO was founded by Sam K before he founded Frax Finance? That’s right! BrainDAO’s flagship product is their IQ.wiki, which is the crypto encyclopedia. We have nearly all of our Flywheel guests wiki page on there so be sure to check that out!

Additionally, you can stake IQ today to earn a whopping 126%. There are 1745 holders of IQ on Ethereum but only 178 are staked. There’s definite value in staking as the treasury is $15.8M. There needs more governance power to secure and direct the treasury.

Be sure to go to the staking page today here.

FrxETH supply and distribution

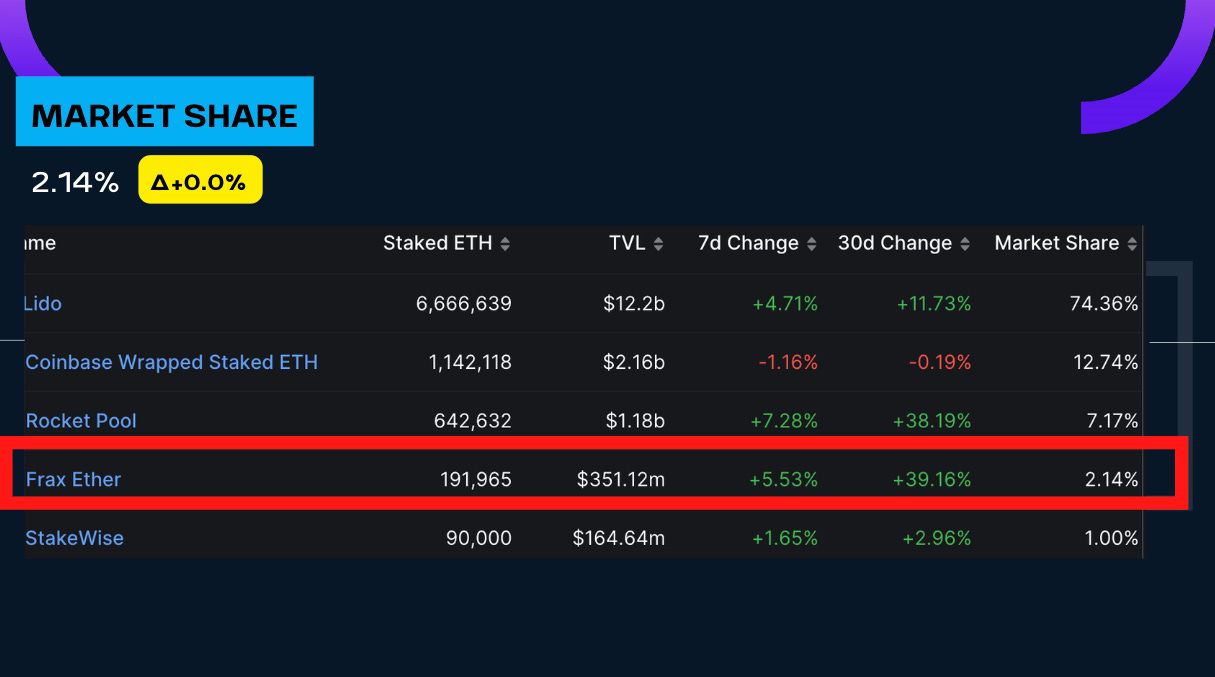

Now onto the crowd favorite, le frxETH. We rocking strong here with 191,955 frxETH supply, a 5.5% increase from last week. We’re tapering off a bit when compared to the initial pump in deposits right after Shapella upgrade but we’re doing good. Onward we march.

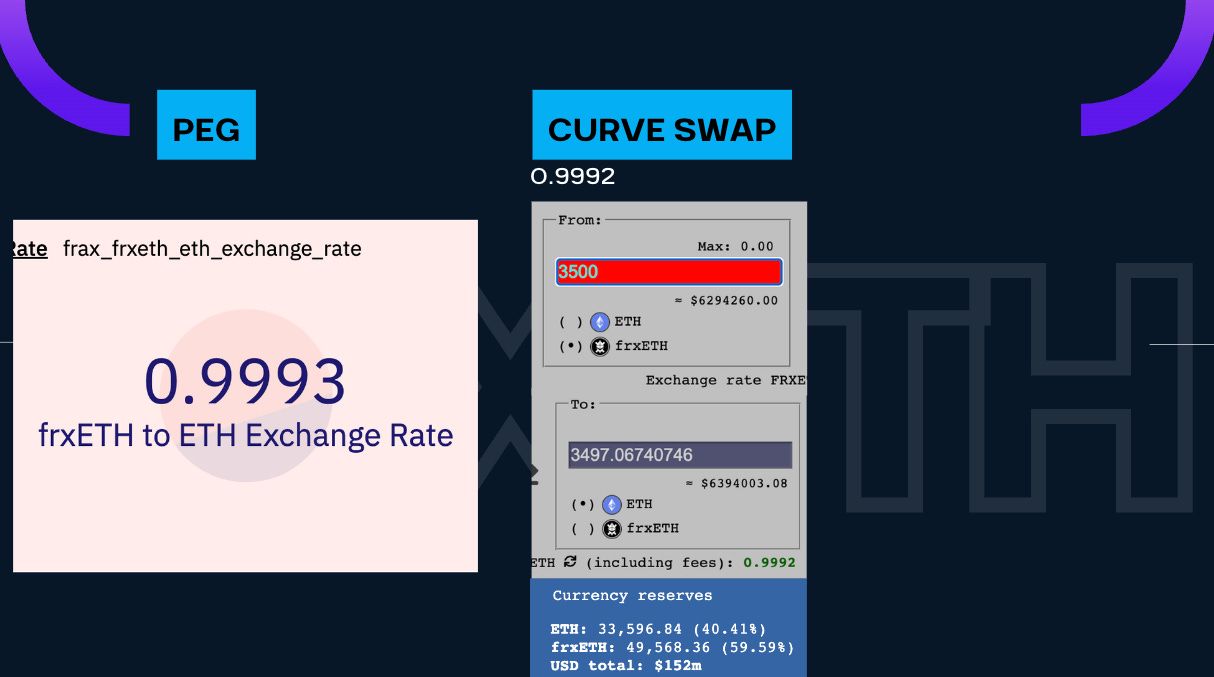

FrxETH peg

Reminder, frxETH is still a stablecoin, just a stablecoin pegged to ETH instead of the dollar. So we must check the peg. Here the dashboard shows 0.9993, a fairly strong rate, but we can’t just rely dashboards. In the markets, we swapped 3.5k frxETH for ETH via Curve and received an exchange rate of 0.9992, which is also a very strong exchange rate. Arguably, one of the best rates in the LSD landscape.

Competitive landscape

Speaking of landscape, let’s look at the LSD market. Unfortunately, this week we are flat. We are at 2.14%, which was frankly the same as last week since Lido, Rocketpool and many others also experienced increase in their ethLSD supply. But you know the one department frxETH is dominating is in the yield arena. Here we witnessed one of the higher APY at 9.2% — that sweet native ETH yield.

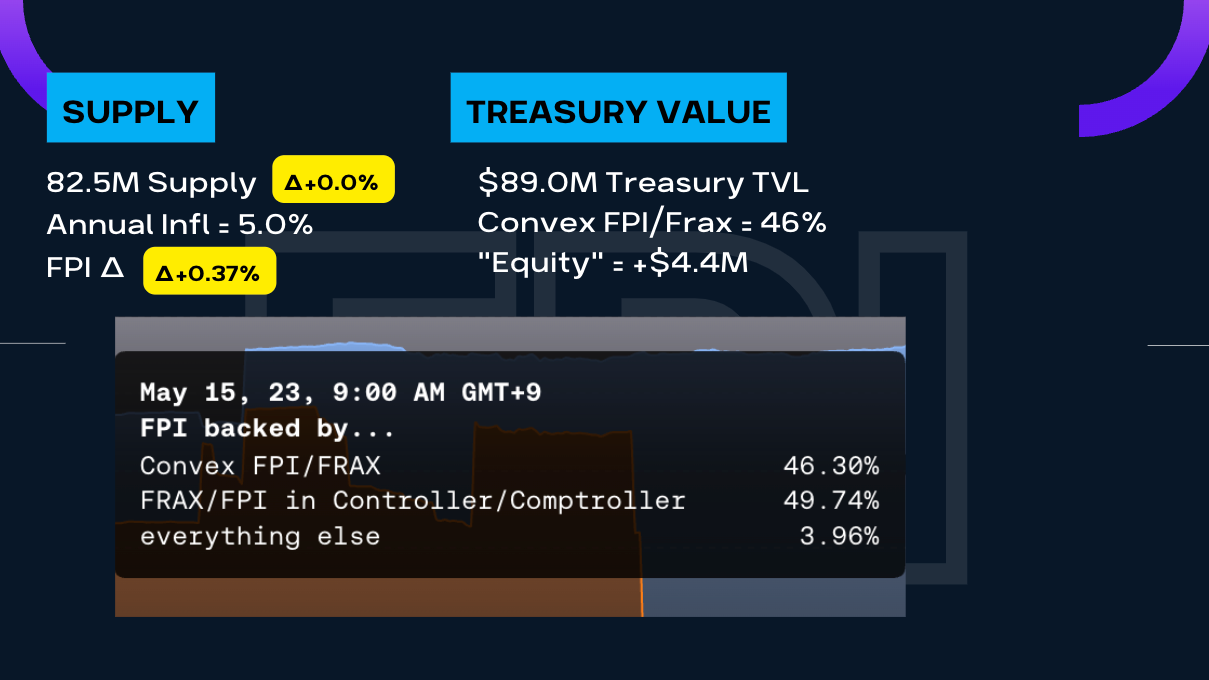

FPI

The FPI has remained quiet for sometime now since the release of veFPIS. We saw the supply at 82.5M but note that FPI is actually above the required peg by 37 basis points. The Treasury TVL also increased by $100k to $89M. We like to see the Treasury TVL increasing as well as the equity value increasing.

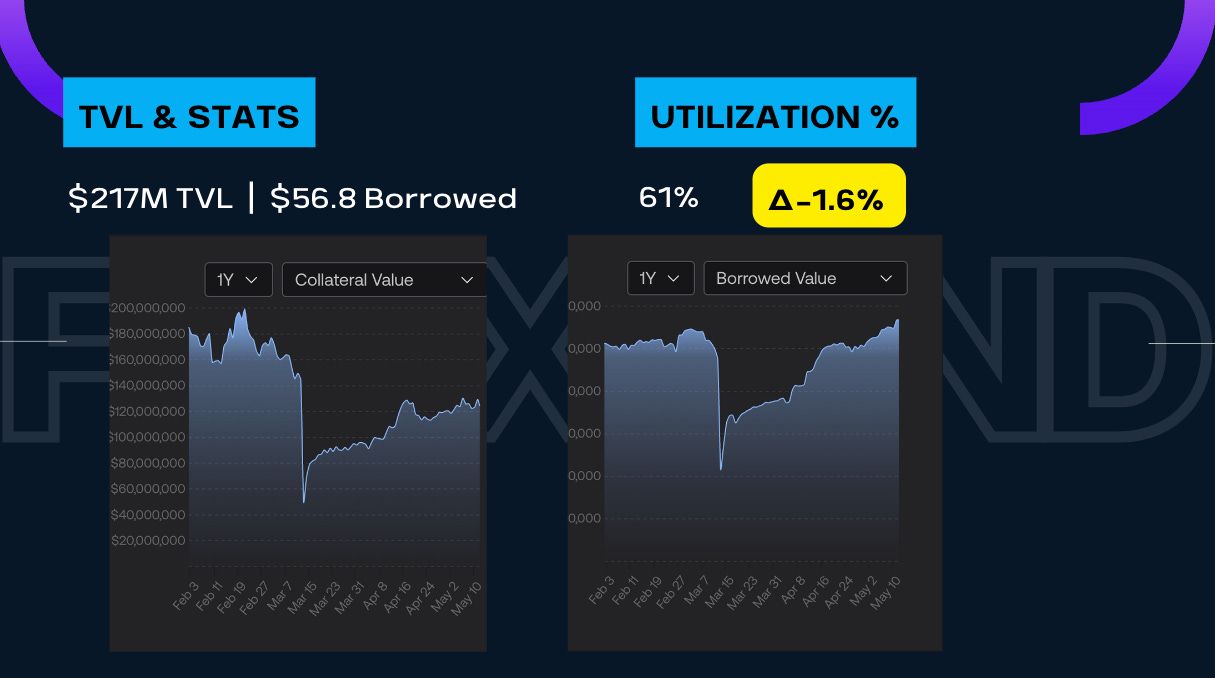

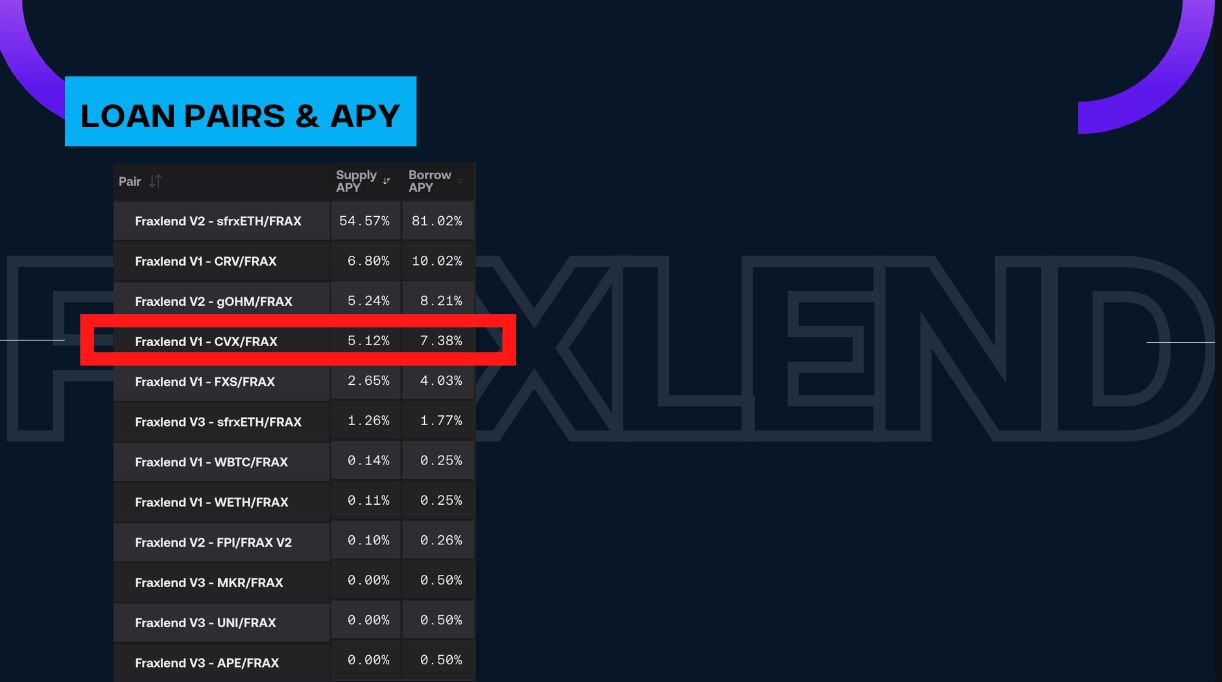

Fraxlend

One of the pillars of the DeFi Trinity is the lending peg so here we have FraxLend. This week we have 217M in TVL with 56.8M borrowed. This represents a 61% utilization rate. We really want to see the utilization rate in the mid 70s to low 80s but as you can see in the collateral value graph, we’re far from where we were prior to the Circle conundrum. Though our borrowed value has pretty much recovered so you know folks are quite levered right now — and we have evidence of this later on this post.

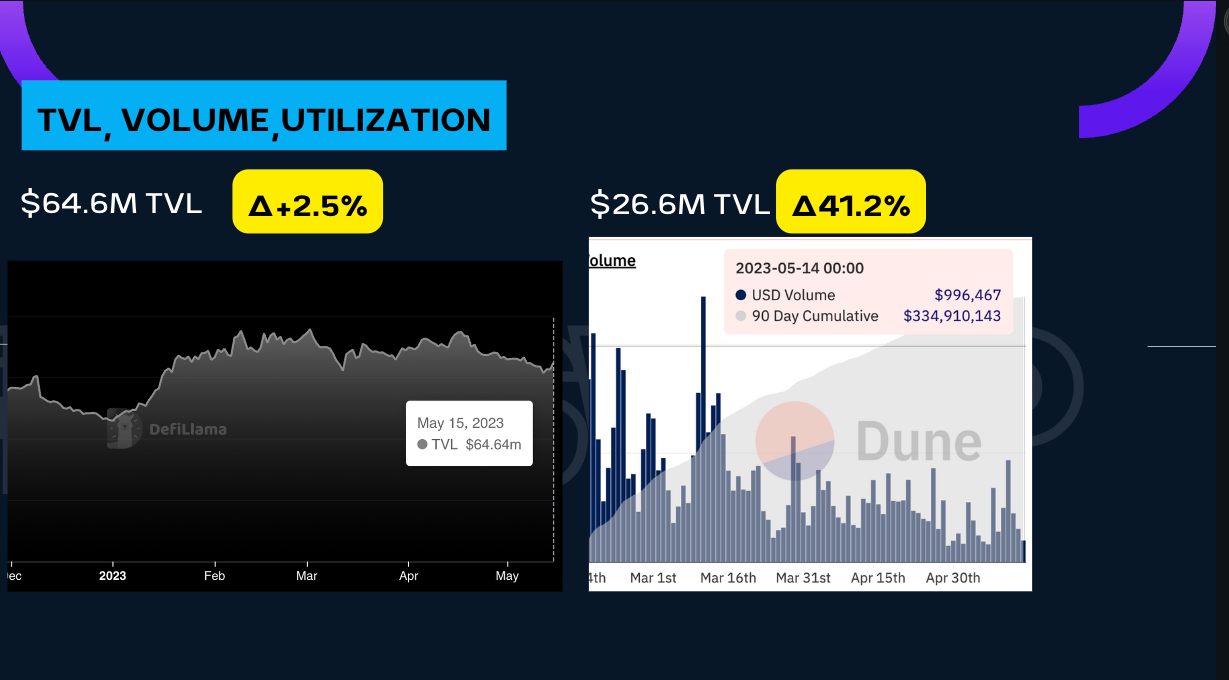

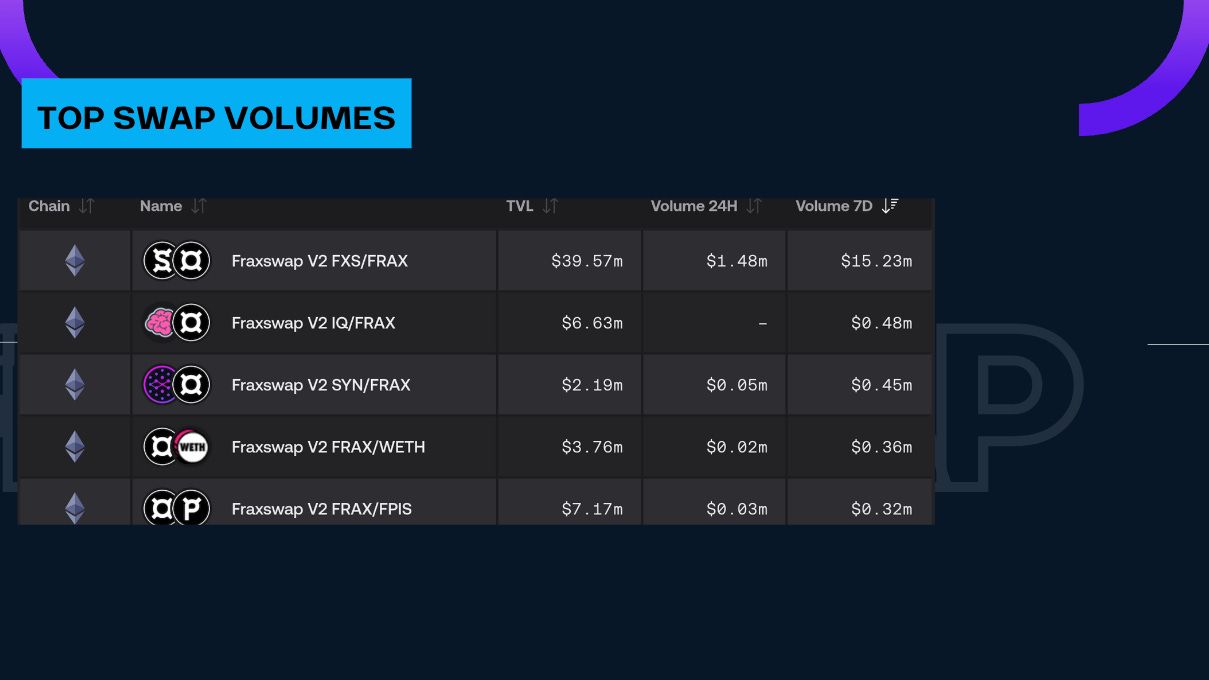

Fraxswap

Lastly we have the final leg of the DeFi Trinity with FraxSwap. We like to call this the Dex that no one talks or know about but its pushing out major volume relative to its size. There are only 64.6M TVL across all the pools yet it facilitates 26.6M in volume which is a 41% utilization rate, and it’s only half the month so far!

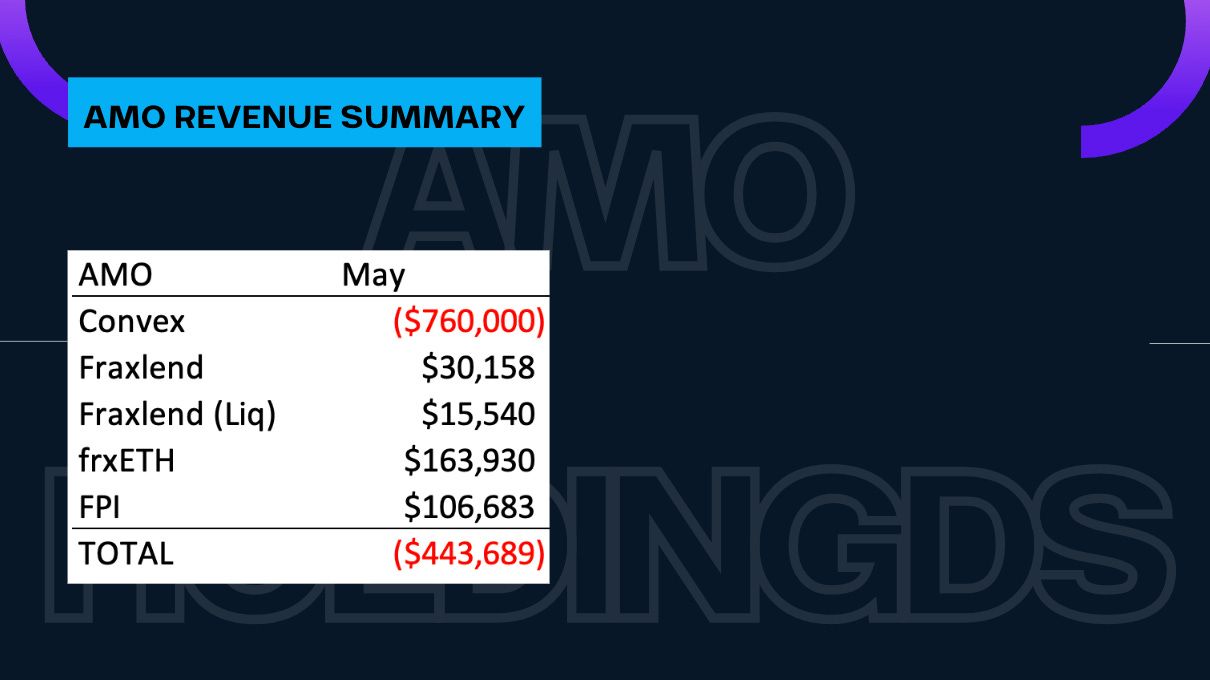

Revenue, Expenses, Profit

Show me the money! Well here it is. We know this month is going to be an expensive month for the Convex AMO since the bribe epoch payment fell on the 1st of this month. We’re experiencing it now with a loss of $760k in the Convex AMO. But do not fret as the other AMO’s and revenue streams are stepping up. For FraxLend, we’re pulling in about $15.1k per week so we’re at $30k for May. As aforementioned, folks are quite levered on FraxLend so we have liquidations into the low six figures which gave us a $15.5k in liquidation revenue. We don’t want to see this but we’ll welcome the revenue. Following we have the frxETH revenue which we calculated by taking the quantity of frxETH multiplying it by 7% for the staking yield then multiply again by 8% to get Frax’s fee share then a final multiplication with the price of ETH and finally dividing that by 12 to get the monthly figure, which is $163k — awesome. Lastly, we have the FPI which generated $106k in profit, that is after the requirement for the peg.

That is it for this week folks! See you next week.

ACCESS TO SLIDES: Here

Not financial or tax advice. This article is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This post is not tax advice. Talk to your accountant. Do your own research.