InfinityPools are a forthcoming leveraged trading platform that takes advantage of Uni V3’s option-like characteristics. The protocol uses its architecture to provide high leverage trading for any ERC20. However, as with any trading strategy, there are tradeoffs that must be accepted by LPs

But what exactly are InfinityPools and why are they so revolutionary?

What It Is & How It Works

InfinityPools are an oracle-less decentralized perpetual exchange utilizing UniV3 mechanics to allow for leveraged trading with near-infinite leverage and no liquidations.

With InfinityPools, traders take fixed duration loans against existing Uni V3-like positions. They pay an upfront fee to cover the fees for the duration. If at the end of the trade, their position has a negative balance, the assets are returned in kind to the LP. However, if the trade is in profit, they can either extend the duration of the loan and continue to pay interest, or they can close and collect their profits.

This sounds too good to be true but hear us out for a second. This explanation requires an understanding of Uniswap V3.

Providing liquidity to Uniswap V3 pools is similar to selling options. By creating a range based Uni V3 LP position, you go short Gamma and collect Theta. This is just fancy speak that means you make money as long as price stays within your range.

As an LP, when you are short Gamma, the risk you take on is that the asset price moves too far, too fast, and the fees you collect don’t offset the price movements. LP’s typically provide liquidity over a single or multiple ranges to ensure they have a wide enough range to ensure near constant fee collection while tight enough to maximize returns.

In options land, Uni V3 risk profiles are most similar to a covered call. The expectation is that price stays within the bands. If it exits, you lose money, or in the case of Uni V3, you suffer impermanent loss.

It’s not entirely perfect to call a covered call a range order, but the risk profiles are very similar. Remember above we said that all InfinityPools trades are fixed duration. This means that as an LP, you have no power or control to remove your assets if the market is moving against you. You effectively trade for higher yield (theta) in return for being yield insensitive. So while it’s great to be an a trader at IP (no liquidations, fixed duration trades, etc), this simply means that LPs lose a ton of protection against Gamma risk.

Let’s look at a couple of trades from both sides, trader and LP, to better understand the mechanics. The most important distinction to understand about InfinityPools is that it removes the ability of the LP to remove their assets.

Assuming we’re all caught up here, let’s dive in.

Imagine the price of ETH is $1000 and we have a Liquidity Provider contemplating where to deploy 900 USDC into a UniV3 position. Let’s call her Alice. Alice is slightly bearish; she expects ETH to drop to $900 so she provides liquidity in a single-tick wide band at $900 ETH with her 900 USDC. Currently, her position is out of range, so she won’t earn any trading fees – a big fat zero return.

But when Alice decides to utilizes InfinityPools, she would earn a yield even when she is out of range. Here’s why.

Now, imagine again that there’s a trader named Bob, who believes that ETH is going to the moon, but he only has 100 USDC so he wants to take on that sweet-sweet leverage. He wants to go big, 10x-leverage big. Bob puts up 10% of the collateral in ETH, which is $100 in ETH (at the current price of $1000, that equals 0.10 ETH), and borrows 900 USDC from the InfinityPools. For this loan, Bob must pay an interest fee upfront that’s set by the utilization rate – but for now let’s assume 12% APR.

The terms of the loans are:

- Principal = 900 USDC

- Interest = 12% APR (paid upfront)

- Terms = Exponential expiry over a 7-day period (but can be repaid in full anytime)

- Loans have a half-life of a day (this will be explained later in the article)

ETH is still $1000. Bob takes Alice’s 900 USDC and purchase 0.90 ETH.

So, he now holds 1.00 ETH (0.10 ETH collateral plus 0.90 ETH he just bought). This ETH is locked in InfinityPools and removed from the liquidity pool.

Bob is pumped since he got his leverage, and his body is ready for Valhalla. Alice is stoked. She’s earning 12% APR, while being out of range, meaning she’s taking zero market risk.

Check out these two scenarios:

- [Scenario A] ETH Moons – ETH hits new All-Time-High (ATH) of $5000. Bob sells his 1.00 ETH for 5000 USDC, then he repays his 900 USDC loan and pockets the remaining USDC. Everything is great and everyone is happy. Bob made a killing and Alice earned 12% APR on her idle capital.

- [Scenario B] ETH Dumps – ETH drops to $100. Bob decides to close his position. He lost his 0.10 ETH collateral. Bob is sad. Recall that Alice provided 900 USDC into the pool in a single-tick wide band at $900 ETH. Since ETH is $100, that means Alice’s 900 USDC LP position fully converted into 1.00 ETH. Therefore, the InfinityPool Protocol will take Bob’s 1.00 ETH and give that to Alice. Alice is satisfied as she had earned a 12% APR on her 900 USDC plus she got to purchase ETH at $900 – her desired price.

Note that regardless of how low ETH dropped in price, Alice is always made whole, and Bob never had to increase his collateral, nor did he get liquidated even when the price dropped 90%. This is because the position was fully backed at the point of origination.

When ETH is above $900, Bob owes Alice 900 USDC and since ETH is worth more than $900, Bob could fully repay Alice. When ETH is below $900, Bob owes Alice 1.00 ETH and since Bob already has the 1.00 ETH, he simply just gives that ETH to her. That’s the math magic or “mathgic” of InfinityPools.

Benefits & Drawbacks to Liquidity Providers (LPers)

As stated previously, InfinityPools removes volatility sensitivity and Gamma protection from LPs by locking their assets into a trade. In return LPs earn an additional yield along with base trading fees from lending their assets to traders.

We have an exclusive look at InfinityPools’ UI, and this should look familiar as it’s basically the same as Uniswap V3’s frontend. The LP sets their desired liquidity band; it’s a set-it-and-forget-it situation.

Now even though the selected liquidity bands may be out of range, the underlying liquidity could still be lent to traders so the LPs earn an interest payment for providing their capital. No market risk while still getting a return sounds sweet, but it’s not without some drawbacks.

The LPs have two withdrawal options: [1] Withdraw Gradually; [2] Withdraw Now.

Option 1 enables the LPs to exponentially pull their capital over a 7-day period. For example, on Day 1 the LP withdraws 50% of their position; on Day 2, they withdraw 25% of their position; on Day 3, they withdraw 12.5% of their position, so forth and so on until Day 7.

A hidden benefit of this 7-day gradual withdrawal is that the LPer is protected from Just-In-Time (JIT) snipers. These snipers do not want to deal with the delayed unlock as they need their capital back effectively within the same block that they provided liquidity in.

Option 2 allows for immediate withdrawal of 100% of the LPer’s position but it comes with a price. This fee is set by the utilization rate of the pool so effectively the LP is taking out a loan – just like the trader did – to withdraw their full position and the LPer must pay the interest rate upfront.

Ok so given all this, when the market goes haywire in any direction, you have no recourse to exit your trade, except through paying fees to the protocol. If you get caught in a high Gamma event, which means the market moves really far and fast, there’s no way to adjust your asset positioning.

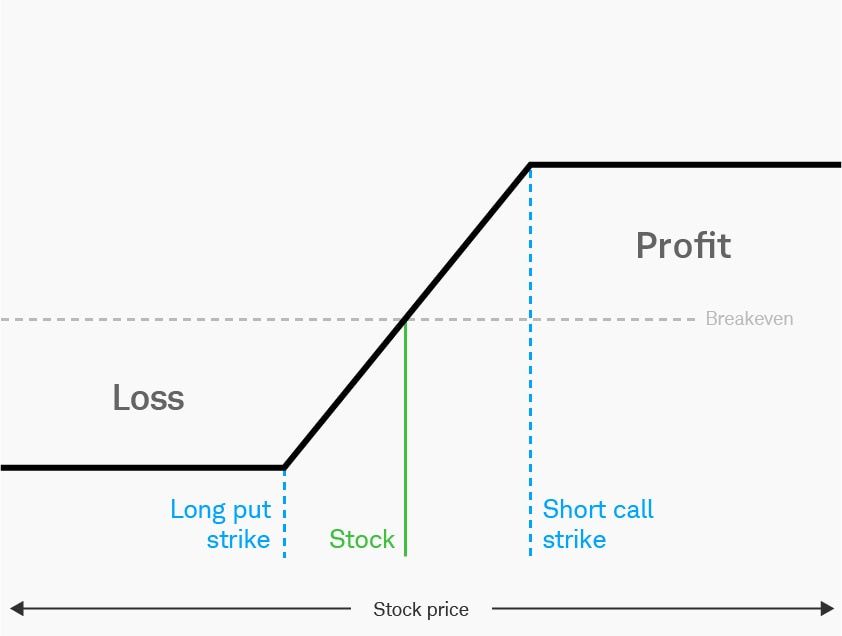

For larger market cap assets like ETH and BTC, there is always a possibility of hedging using CEX derivatives. You could buy a put option at or below your range low price with the expectation that the yield and interest income will outpace the option premiums. Congrats, you now have a modified options collar.

InfinityPools are marketing itself as a platform where any token pair can be created and traded with leverage. It’s actively marketing itself as a place where high leverage shitcoin trading will operate. In these environments, market makers will not be able to hedge. In this scenario they take on an incredible amount of Gamma risk that caps profits on the upper bound and with near 100% losses possible on the lower. If SUPERPEPEMOONCOIN drops 70% while stuck in the protocol, there’s no way to hedge losses. LPs are screwed, as the utilization rate maxes out, much like an Aave/Fraxlend loan with no liquidation mechanism. They just have to eat the bad debt (Gamma) in this case.

Aave loans with no liquidation are probably the best way to think about being an LP. You lend your assets to the protocol, who then lends those out for interest. It’s a fixed term and you have no power to recall or liquidate. As an LP, your only choice is either to withdrawal gradually (less bad), or fully withdrawal with fees (weirdly bad). Adding fees to withdrawal immediately is necessary, LPs would just rush to the exit during high volatility periods.

Assuming that the professional market makers will provide liquidity, the interest rates charged to traders will have to be quite high to cover their premiums. Since the market makers will be have to be forward looking for volatility, they have to assume much higher volatility scenarios since they won’t be able to adjust liquidity once its deployed. All of this will be passed back through in the form of interest rates paid by traders. It’s going to be extremely pricey comparatively versus other platforms, not including any of the trading fees. Especially for shitcoins… the fees should be extremely high to compensate for the risk LPs take.

How high the interest rates will get is a function of the utilization rate. A couple of questions we failed to ask during the interview was how fast they would respond. It’s all good if interest rates can go to infinity, but high volatility markets require a rapid shift upwards to ensure market participants remain incentivized to keep their deposits in the protocol.

So what’s a good interest rate to lend shitcoins at? Especially meme coins and other super high vol instruments? 1000%? 3000%? 10,000%? Remember, the risks are not just in the downside, when markets move higher rapidly, as the LP you’ve missed the opportunity to re-range upwards when your original position goes out of range. With a 1 week withdrawal time, shitcoins could 100x, as PEPE did. The lost opportunity of lending to Infinity Pools could be immense.

Traders will probably love the set and forget aspect of Infinity Pools. Liquidity providers probably are getting bad deal. As a result, the protocol might have trouble attracting TVL. Market makers are some of the most volatility sensitive actors in trading; by removing or taxing their ability to adjust spreads or redeploy assets, Infinity Pools is simply transferring costs and risks in a non-traditional way.

Benefits & Drawbacks to Traders

Traders put up minimal collateral, based on leverage and utilization rate, to acquire the desired amount of leverage and interest payments. Additionally, the trader gets to decide where they want to route their swap order, though many will opt for the default option, which is the 1inch router.

The benefits are clear: low collateral, near-infinite leverage, and no liquidations. But obviously there are tradeoffs.

The risks are that the trader effectively gets TWAP’d out of their position over a 7-day period unless they continue to take out new loans at new interest rates. For example, if a trader borrowed $900 for a leveraged long position and on every block $1.00 of the loan will expire, then to maintain their position size, Infinity Protocol will initiate a new loan of $1.00 on the trader’s behalf and the trader’s collateral will be deducted to pay for the interest. This sounds troublesome but the protocol does all this under the hood so the only decision the trader needs to make is either to maintain or close the position.

There will be a point in time, in which the trader will run out of collateral to pay the interest payments to originate new loans and at that point the trader’s position will get TWAP’d away. Although the trader does not suffer liquidation due to market price action, the interest rate payments is a key risk to monitor.

Conclusion

InfinityPools is a new DeFi primitive that combines an AMM with leveraged trading. InfinityPools delivers five 10x improvements by providing: (1) more assets; (2) faster listing; and (3) near-infinite leverage as well as (4) protecting users from liquidations due to market price and (5) counterparty risk.

But there are clear risks to LPs who use InfinityPools. They will have to charge sufficient fees to compensate for their risks. However, Flywheel is excited for this new capital-P Primitive and can’t wait to test it.

InfinityPools are launching their testnet soon. Follow them on Twitter for all the latest updates.

CAVEAT: This is a high-level overview of InfinityPools and its mechanics. The author based the analysis and explanation of InfinityPools on their independent research as well as the podcast interview with the founder of InfinityPools. The examples and simulation used in this article is based on simplified scenarios and do not represent what may occur. For further research and a deeper dive into the math, please refer to the project’s Discord (where the whitepaper is located).