Are you ready for Arbitrum Short Term Incentive Program (STIP)? The massive 50m ARB incentive campaign is kicking off this month to huge expectations. Over 26 projects were voted to take part in the round and many more have recently been backfunded.

Frax was one of the 26 protocols selected to receive grants for this round... and Flywheel has all the details about how their 1.5. ARB will be used. Let's dig in.

What is Arbitrum

Arbitrum is a Layer 2 scaling solution for Ethereum, boosting transaction speed and reducing costs. It offloads complex tasks from the main Ethereum blockchain (Layer 1), processing transactions in batches, which reduces congestion and fees. Popular DeFi apps, GMX, Umami, and Dolomite all call Arbitrum home.

Arbitrum uses optimistic rollups for efficient transaction processing. These rollups compress and batch transactions off-chain before finalizing them on-chain, optimizing block space and gas fees. They are "optimistic" because they assume most transactions are valid, with disputes handled through a week-long verification process.

The Arbitrum ecosystem, growing rapidly with a 50% year-over-year increase in developer headcount, includes several key products: Arbitrum One, Nitro, and Nova.

Arbitrum One, launched in 2021, is the mainnet, running on the Arbitrum Virtual Machine compatible with Ethereum's.

Arbitrum Nitro, an upgrade to Arbitrum One, offers faster processing and EVM compatibility.

Finally, Arbitrum Nova, another chain in the ecosystem, focuses on reducing transaction costs for applications like games and social dApps, sacrificing some security for scalability and lower fees.

What is the Arbitrum Arbitrum Short-Term Incentive Program (STIP)?

The STIP is a one-time initiative created by the Arbitrum Incentives Working Group. It's designed to distribute up to 50,000,000 ARB, funded by the DAO, to support active Arbitrum protocols. The program's main objectives are:

- Support Network Growth: It aims to accelerate the distribution of incentives to Arbitrum decentralized applications (dApps) to drive growth in the network and ecosystem.

- Experiment with Incentive Grants: The program seeks to explore new grant distribution strategies to increase user engagement and enhance transaction volume, liquidity, and overall activity within the Arbitrum ecosystem.

- Generate Incentive Data: By distributing these grants, the program intends to collect data on their effectiveness, informing future incentive programs and designs.

The STIP has a budget of 50,000,000 ARB for grants to eligible protocols.

Frax's STIP budget and strategy

Frax's strategy for the Arbitrum STIP focuses on leveraging its brand to attract new users and assets to Arbitrum, enhancing the competitive landscape for stablecoins and staked Ether, and establishing permanent capital flows into Arbitrum from Ethereum. The goal for Frax will be to draw in new liquidity to Arbitrum and broaden its user base.

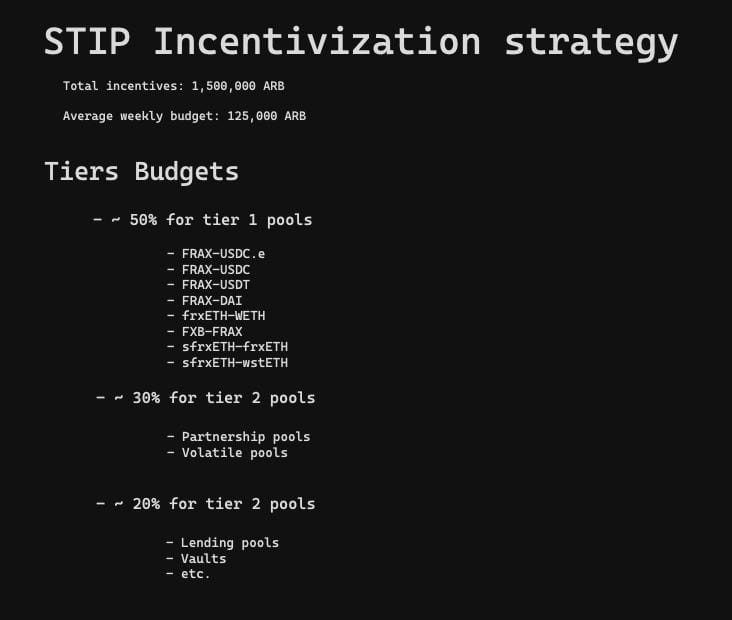

The grant, totaling 1.5 million ARB, will be used to incentivize Frax asset LPs and other DeFi protocols during a 3 month period. Each week, Frax will distribute 125k ARB between selected LPs. The rewards will be distributed base on the following tiers

50% of all the rewards will go to Tier 1 pools. These are:

- FRAX-USDC

- FRAX-USDC. e

- FRAX-USDT

- FRAX-DAI

- frETH-WETH

- FXB-FRAX

- sfrxETH-frETH

- sfrxETH-wstETH

30% for Tier 2 pools

These will be partnership pools and other volatile pools that are not Tier 1. Any new LP pairing with Frax may apply for these pools using this link.

20% for Tier 3 pools

This will cover non LP trading pairs like lending pools, Vaults and other protocols selected by the Frax DAO.

What pools will be eligible for Frax STIP rewards?

Based on this post on the Arbitrum forums, the following pools are eligible for Frax's STIP rewards.

| Contract | Address |

|---|---|

| Lending - Aark - FRAX | 0x7A5df878e195D09F1C0bbba702Cfdf0ac9d0a835 |

| Lending - Aave - FRAX | 0x38d693cE1dF5AaDF7bC62595A37D667aD57922e5 |

| DEX - Curve - FRAX/USDC.e | 0xc9b8a3fdecb9d5b218d02555a8baf332e5b740d5 |

| DEX - Curve - frxETH/WETH | 0x1deb3b1ca6afca0ff9c5ce9301950dc98ac0d523 |

| DEX - Curve - USD±FRAXBP | 0xb34a7d1444a707349bc7b981b7f2e1f20f81f013 |

| DEX - Curve - fxUSD-FRAXBP | 0xab174ffa530c888649c44c4d21c849bbaabc723f |

| DEX - Curve - IN-FRAXBP | 0xc9fb013da36fad6422dabb4f2ddfdaaca17205e6 |

| DEX - Curve - axlUSD-FRAXBP | 0x741aea6c7707b39bd950da945f84d6b8ba455d48 |

| Lending - Fraxlend - FRAX/ARB | 0x2D0483FefAbA4325c7521539a3DFaCf94A19C472 |

| DEX - Fraxswap - FRAX/WETH | 0x0BB5A573886bbcecf18590b6Cb59E980FAC7d278 |

| DEX - Fraxswap - FRAX/FXS | 0x90FF2b6b6a2eb3C68D883bc276F6736b1262fa50 |

| DEX - Fraxswap - FRAX/ARB | 0xf9901732A568e7030126E1b3676a4fcd29907B08 |

| Lending - LFRAX - FRAX/LFRAX | 0x2E9963ae673A885b6bfeDa2f80132CE28b784C40 |

| Lending - Lodestar - FRAX | 0xD12d43Cdf498e377D3bfa2c6217f05B466E14228 |

| Lending - Lodestar - FRAX | 0xc9c043A7f80258d492121d2f34e829EB6517Eb17 |

| Lending - Notional - FRAX | 0x1344A36A1B56144C3Bc62E7757377D288fDE0369 |

| DEX - Ramses - FRAX/GRAI | 0x9e8a58180dbd369ebe2fc0e8dc671ff9835ce5ab |

| DEX - Ramses - FRAX/USDC | 0x6A9D961c9602fB484bA3C47c5F822b66721C9669 |

| DEX - Ramses - frxETH/FRAX 0.05% | 0x0c9710d820e115ef30829b4675e137dd71b25a14 |

| DEX - Ramses - FRAX/DUSD | 0x9CF9AaE54109cE68991b88EDb0CE3613eBFd7886 |

| DEX - Ramses - FRAX/USDT | 0xc39b54Da0036b8C753c3795ABFE1Ab997b799461 |

| DEX - Ramses - FRAX/alUSD | 0xfd599DB360Cd9713657C95dF66650A427d213010 |

| DEX - Ramses - FRAX/DOLA | 0x1850e96550d6716d43ba4d7df815ffc32bd0d03e |

| DEX - Ramses - frxETH/sfrxETH | 0xf166ff5cd771923d4d4fb870403afc6f13dd2d02 |

| DEX - Ramses - frxETH/WETH | 0x3932192de4f17dfb94be031a8458e215a44bf560 |

| DEX - Ramses - frxETH/wstETH | 0x181d8532e828A9767258296c90662f5050baeA4E |

| DEX - Ramses - frxETH/FRAX 0.05% | 0x0c9710d820e115ef30829b4675e137dd71b25a14 |

| DEX - Ramses - sfrxETH-frxETH 0.01% | 0x31d98f473edf9b23c08884392b5a734e630e8649 |

| DEX - Ramses - RDNT/frxETH | 0x6E6D67C1369e62D73F5CEB99E02b3b5E7b89dbb9 |

| Lending - Stargate - FRAX | 0xaa4BF442F024820B2C28Cd0FD72b82c63e66F56C |

| DEX - UNIV3 - FRAX/USDC.e | 0x46Dc00f9dE3d51182F8686E1F8491645506e2F61 |

| DEX - UNIV3 - FRAX/FPI | 0x53d1e8F6661D6ab7c6487Bf952d21c478041f021 |

| DEX - UNIV3 - FRAX/svUSD | 0x28082db75615849D12f37627E614b479749C7903 |

| DEX - UNIV3 - frxETH/svETH | 0x6a28350341A27e98170b6e8274bF2382B4DAe6AC |

| DEX - Wombat - FRAX/USD+/USDC | 0xf4b72e9a18e4b7c65165e437c57ff6b6202e4505 |

| DEX - Wombat - frxETH/WETH/sfrxETH | 0x6966553568634f4225330d559a8783de7649c7d3 |

How ARB will be deployed with the Algorithmic Incentive Distributer

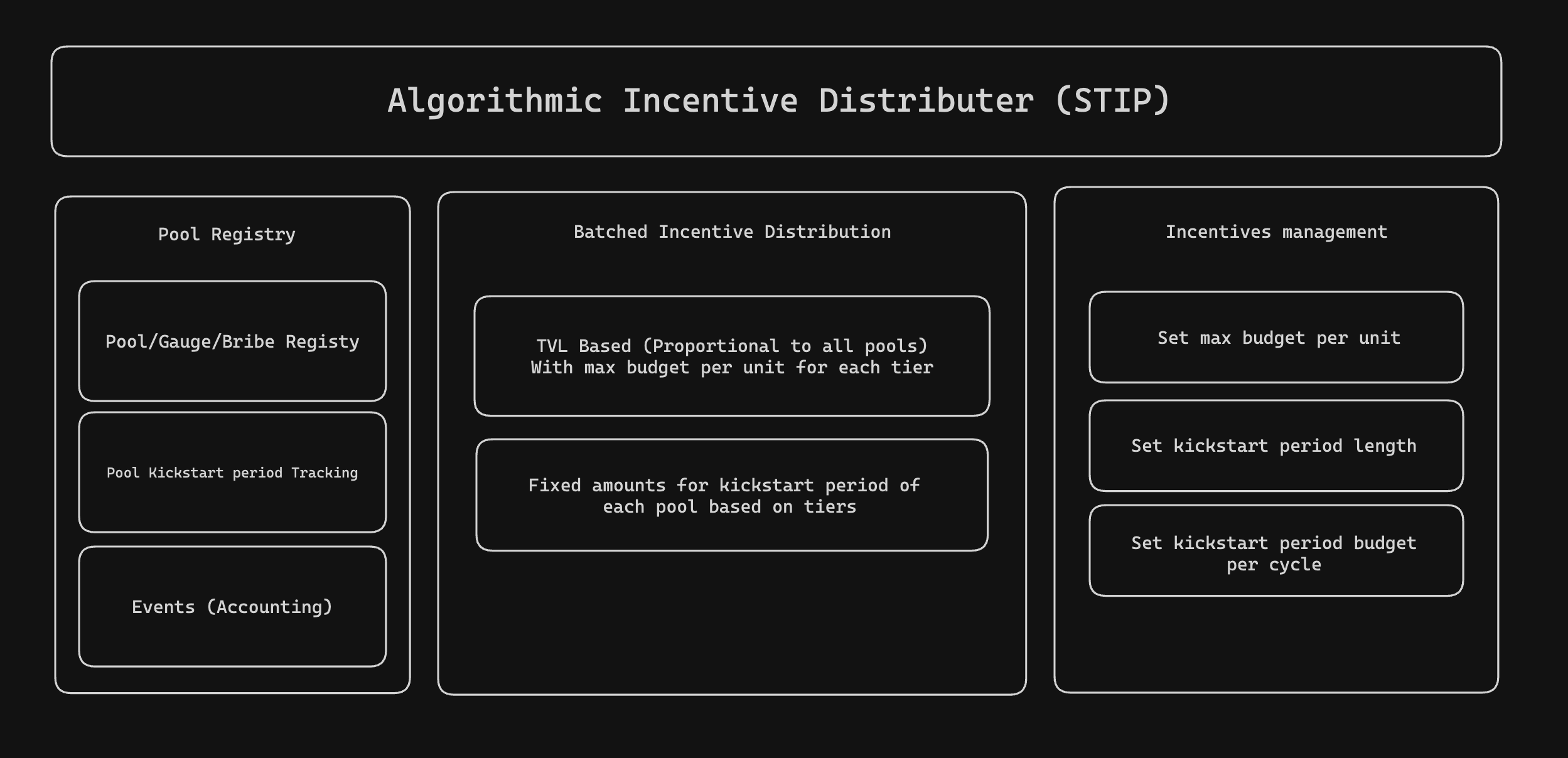

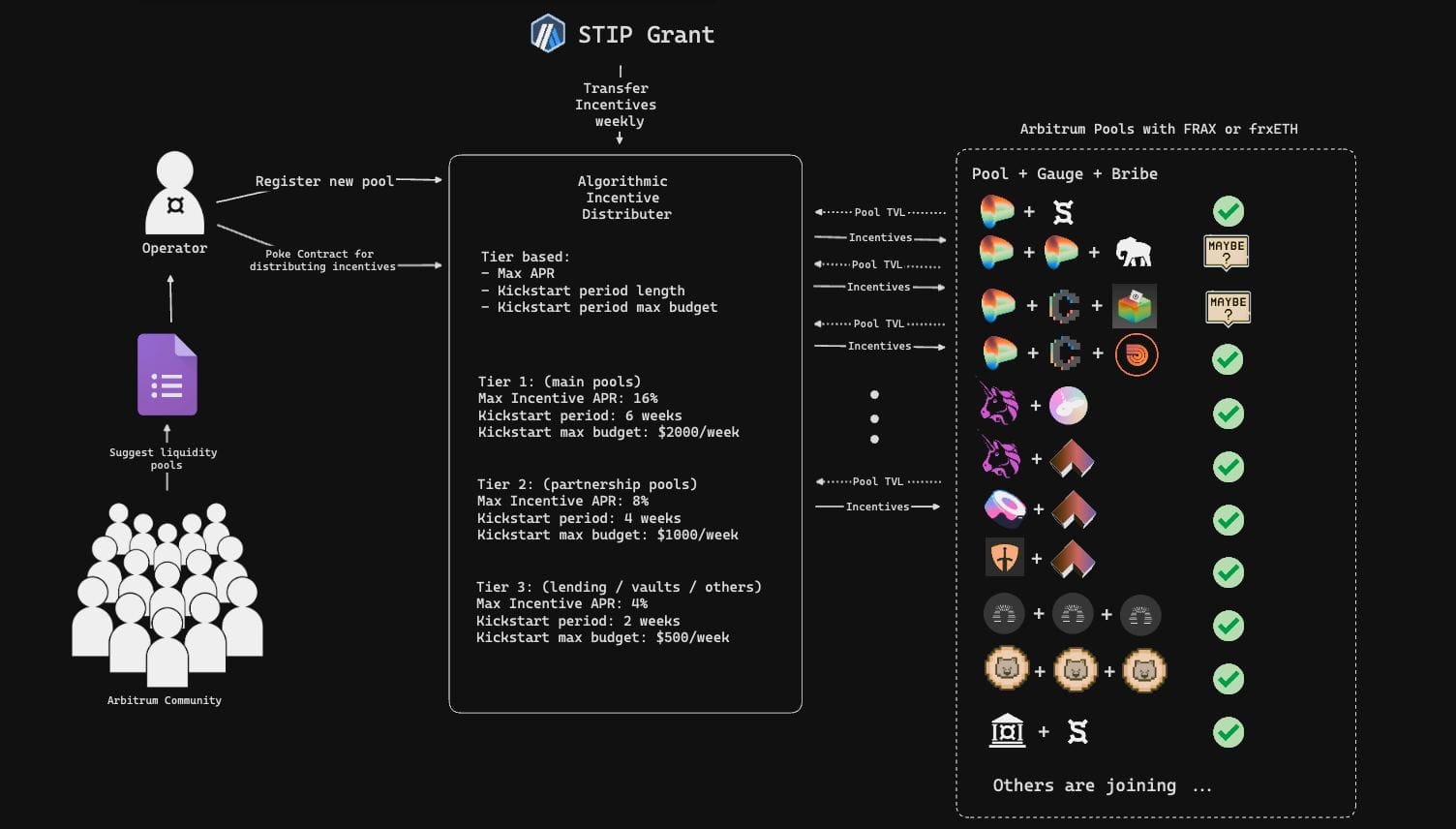

Frax is debuting an innovative way to distribute the ARB STIP grant rewards to individual pools using a mechanism called the "Algorithmic Incentive Distributer" (AID)

The AID distributes ARB STIP rewards based on proportional TVL of all the pools, with a max budget for each tier.

What sets the AID apart from simple manual distribution is that it dynamically will adjust rewards to any pool based on its growth.

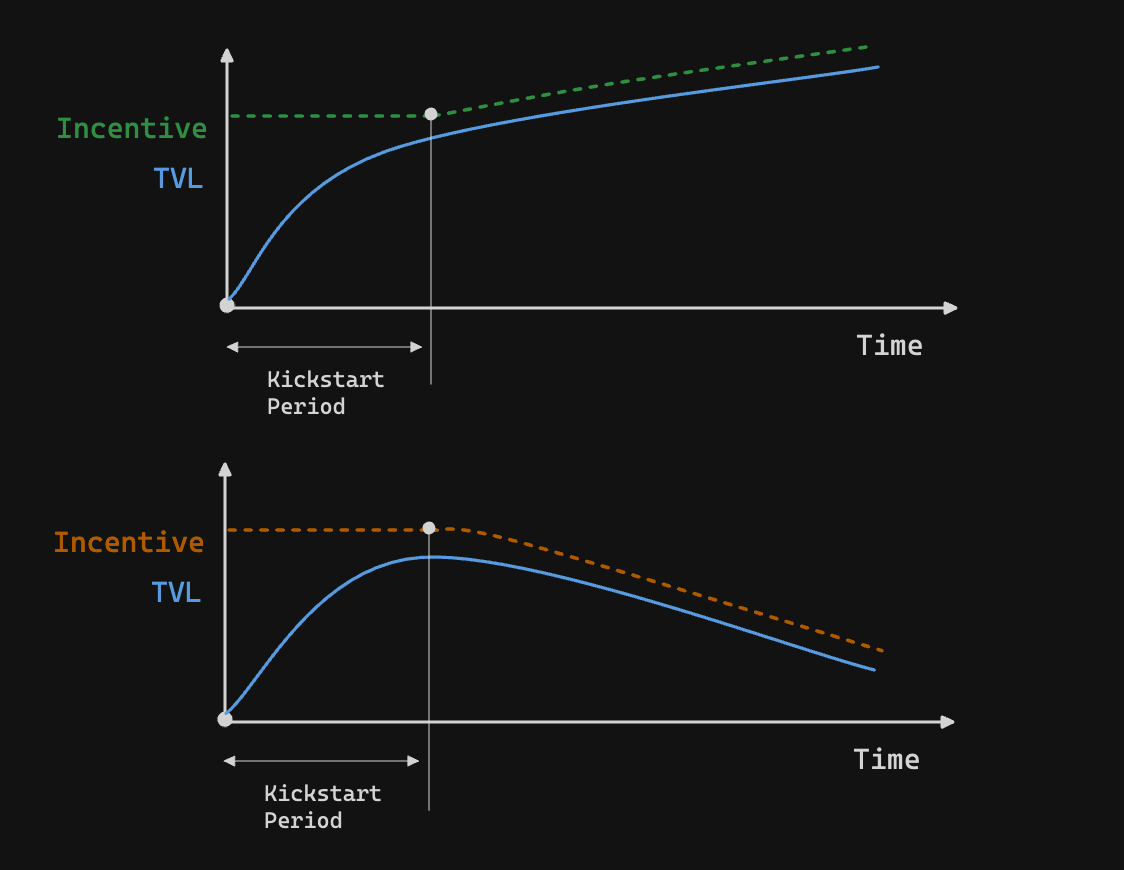

At the beginning of the STIP period, all pools will be set with a fixed distribution amount. After this "kickstarting" period is over, the AID will dynamically adjust each pool based on its TVL. If a pool attracts more capital, it will receive more rewards, and if it loses TVL, then the ARB rewards will be diverted to other pools.

Kickstart Parameters and Length

Tier 1: Main Pools

- Maximum Incentive APR: 16%

- Kickstart Period: 6 weeks

- Kickstart Maximum Budget: $2,000 per week

Tier 2: Partnership Pools

- Maximum Incentive APR: 8%

- Kickstart Period: 4 weeks

- Kickstart Maximum Budget: $1,000 per week

Tier 3: Lending / Vaults / Other Categories

- Maximum Incentive APR: 4%

- Kickstart Period: 2 weeks

- Kickstart Maximum Budget: $500 per week

How to add new pools to the AID

If you would like to add your pool to Frax's AID, follow using this link to register.

You will need to submit the following information:

- Liquidity Contract Type: You need to specify the type of liquidity contract for the pool, such as AMM-Stable, AMM-Volatile, Concentrated Liquidity Pool, Lending Pool, Vault, or Other.

- Frax Finance Token in the Pool: Indicate which Frax Finance token the pool includes. Options include FRAX, sFRAX, FXS, frxETH, sfrxETH, FPI, or FPIS.

- Pool's Name: Provide the name of the pool.

- Contribution to Frax Ecosystem: Explain why you believe this pool contributes positively to the Frax Ecosystem.

- Additional Incentives or Contributions: Detail any additional incentives or contributions expected from other parties for this pool, including specific numbers if applicable.

- Anticipated TVL of Frax Finance Issued Assets: Estimate the Total Value Locked (TVL) of Frax Finance issued assets in this pool three months from now.

- Presence of a Gauge: Indicate whether the pool has a gauge (Yes or No).

- LP Incentivization Mechanism: Describe how the pool's LP incentivization works, choosing from provided options or specifying another method.

- Pool Addresses: Provide various addresses related to the pool, including:

- The pool's address (used for reading TVL of the pool).

- The pool's LP token address.

- The pool's gauge address (if applicable).

- The pool's incentivizing mechanism contract address (e.g., bribe contract).

- Protocol Information: Specify which protocol you are from and describe what your protocol does.

- Contact Information: Provide your Telegram ID for contact purposes.

How to bridge Frax assets to Arbitrum with FraxFerry

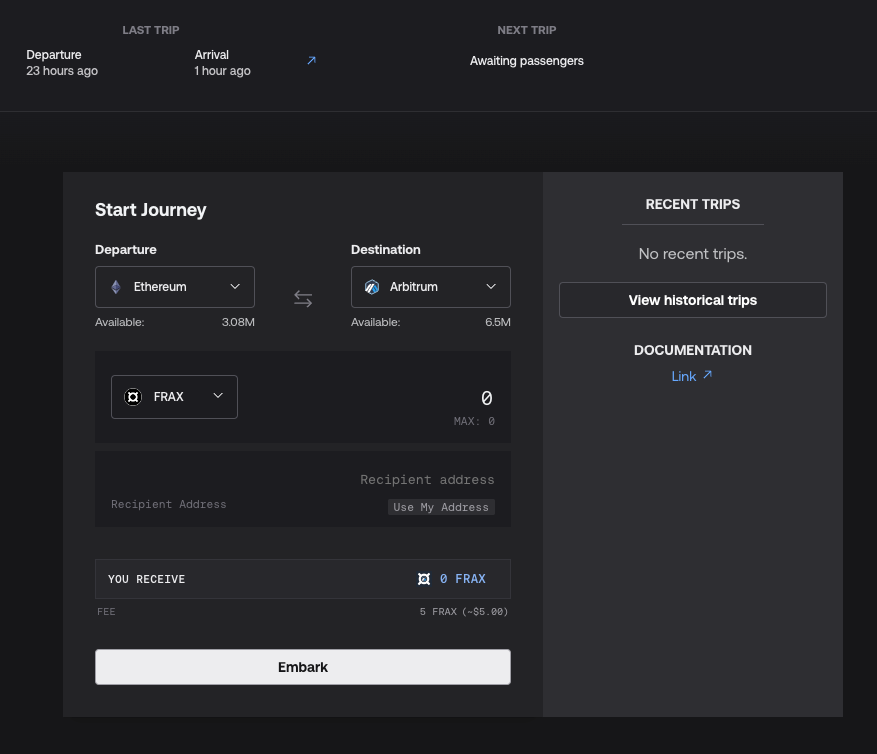

- Open Fraxferry: Navigate to the Fraxferry interface. You'll see the 'Start Journey' panel in the center of the screen.

- Select Departure Chain: In the 'Departure' dropdown, choose 'Ethereum' as your departure chain if it's not already selected by default.

- Choose Destination Chain: Click on the 'Destination' dropdown and select 'Arbitrum' or the specific Arbitrum network you wish to bridge to.

- Select Token: Click on the 'Select token' dropdown menu to choose the specific Frax token you wish to bridge. Options may include FRAX, sFRAX, FXS, frxETH, sfrxETH, FPI, FPIS, or other tokens available in the Frax ecosystem.

- Enter Amount: Enter the amount of the selected token you want to transfer. If you wish to transfer the entire balance, you can click the 'MAX' button, which will automatically populate the maximum available amount of the selected token.

- Input Recipient Address: In the field provided, enter the recipient's address on the Arbitrum network where you want to receive the bridged assets. If you are sending assets to your own address on Arbitrum, you can click the 'Use My Address' button to automatically fill in your connected wallet address.

- Review Fees: Below the recipient address field, there will be a fee displayed. This is the transaction fee for bridging your assets. Review and ensure that you are comfortable with the fee.

- Embark: Once all information is correctly entered and you have reviewed the transaction details, click the 'Embark' button to initiate the bridging process.

- Confirm Transaction: Your wallet will prompt you to confirm the transaction. Review the transaction once more for accuracy, including the network fees that will be charged by your wallet.

- Monitor Transfer: After confirming the transaction, you can monitor the progress. There may be a 'Last Trip' section that updates with the status of your recent and next trips. Ensure that the transfer is complete and that the assets have arrived at the specified Arbitrum address.

Remember to always double-check all details before confirming the transaction on your wallet to avoid any errors or loss of funds. If this is your first time bridging assets or using Fraxferry, consider transferring a small amount first to ensure that everything works as expected.