FrxETH v2 Details Announced

In what turned out to be a huge week, Sam Kazemian gave a presentation to kick off the Dorahacks-Flywheel-Frax Online Hackathon. With the slightly innocuous title of “Frax Build LSDFi Technical Worskshop.” Over 30 minutes he laid out a high level overview of the upcoming frxETH v2 system.

Here are some of the juicy bits.

FrxETH v2 creates a fully decentralized borrowing market for validators.

Validators post collateral and take ETH loans.

The sfrxETH yield APR becomes the interest rate paid by validators for their ETH loans.

Validators will have to post 2-8 ETH collateral to maintain their loan. If they get slashed and their loan health declines, they can either eject or add additional collateral.

The best performing validators benefit the most, as they will be able to maximize their returns versus the base borrowing cost.

FrxGov is an integral part of FrxETH v2 and will be released before its launch.

The code base is almost done (end of June) and will then go off for audits.

We’re really excited to share more info about the upcoming launch of Frax ETH v2 with you next week. We’re going to have an exclusive interview with Sam Kazemian next on the main pod where we will go super in depth about the new product.

Sam goes on the RocketPool Discord

Sam K went into the “Lion’s Den” aka the RocketPool Discord channel immediately after the Dorahacks stream. Suffice to say… it was not initially a warm reception.

Sam then dropped in to ask for clarification on their claims

They gave their best shot

Some members put together some great analogies.

Sam would go on to explain how RPL works.

They kept probing.

And then the tide began to turn.

Slowly… then all of a sudden.

And then the lightbulb goes off.

Haters kept on trying…..

Editors note: This was our personal favorite comment.

Annnnd that’s all folks..

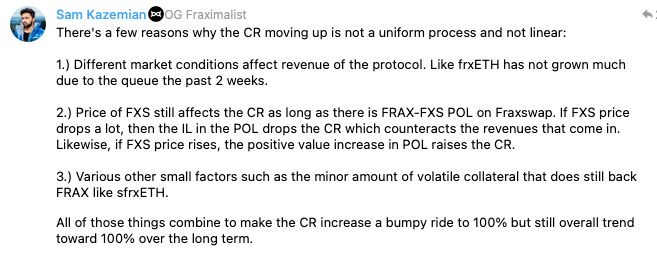

What’s going on with the Collateralization Ratio?

It’s been six weeks since the CR has moved upwards towards its goal of 100%. We asked Sam K this week and his answer was elightning.

So the news is that since FXS is down only for the last month, it’s requiring Frax to increase its contributions to FXS/FRAX protocol own liquidity.

Once the CR hits 100%, though, we are going to have to have a discussion in the DAO about what to do with the revenues.

MoneySwitch provides a 1 year update on Frax’s investments

Over a year ago, the Frax DAO approved investing $250k worth of FRAX in MoneySwitch’s seed round. This week, the liquidity-as-a-service platform specializing in cross-border payments came back to the forum with a yearly update regarding their progress. Some of the most notable highlights from the post is that even when adversity struck in the collapse of UST with MSBs backing out, they were able to persevere and achieve full regulatory approval and compliance in Switzerland. In the near term, they are aiming to launch Q2 this year with partners such as Ava Labs and are seeking to integrate with their Banking-as-a-Service (BaaS) layer of their fintech stack. For those curious to learn more about Money Switch, follow them and check out their resources on Twitter.

CAN WE SAY FRAX MERCH LOUD ENOUGH??

The long-awaited Frax Japan merch has finally hit the store! These special editions long-sleeves were approved of by the Frax DAO and initially given out during ETHTokyo week. These will be a limited run of 100 shirts, get yours today!