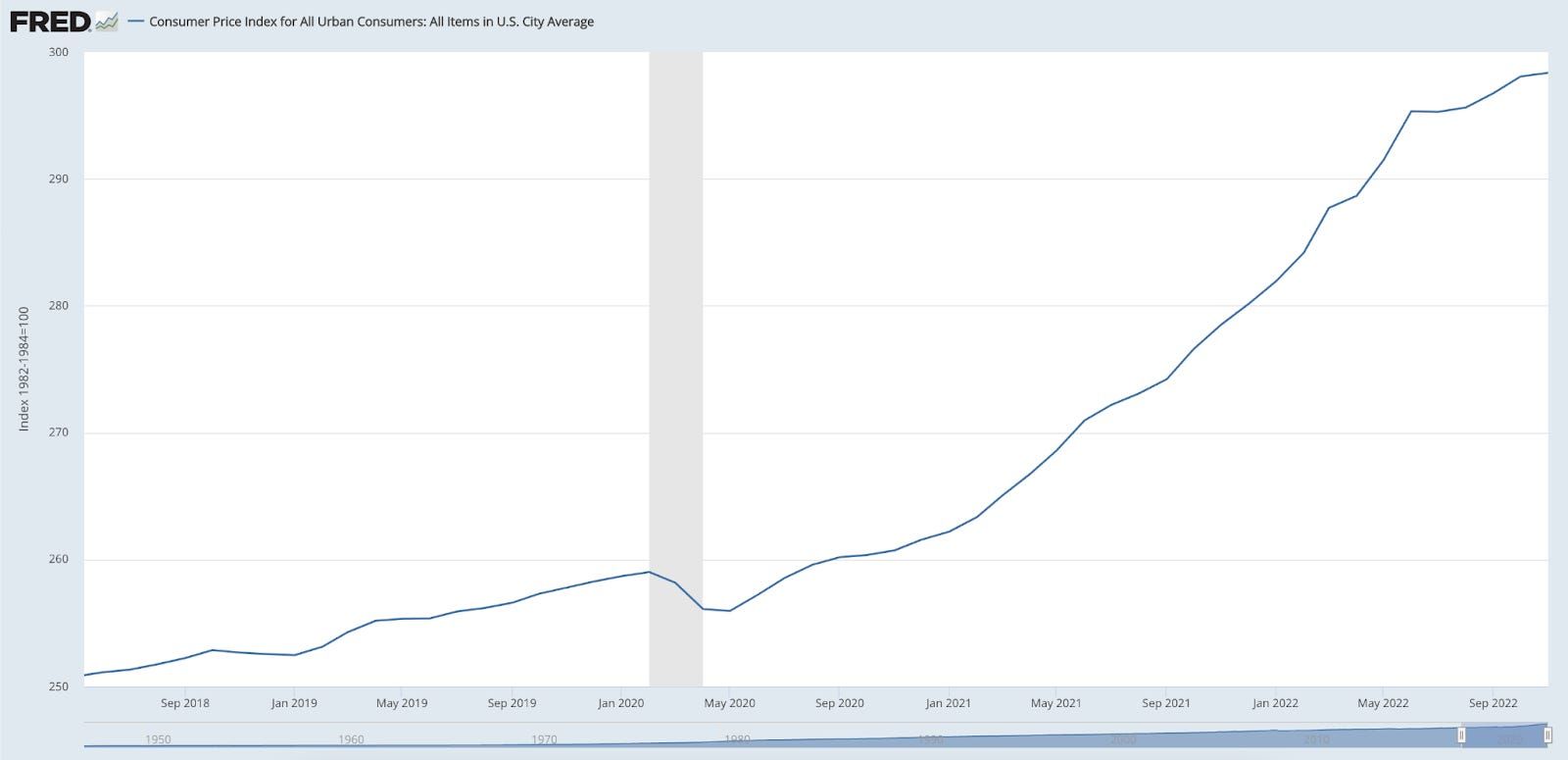

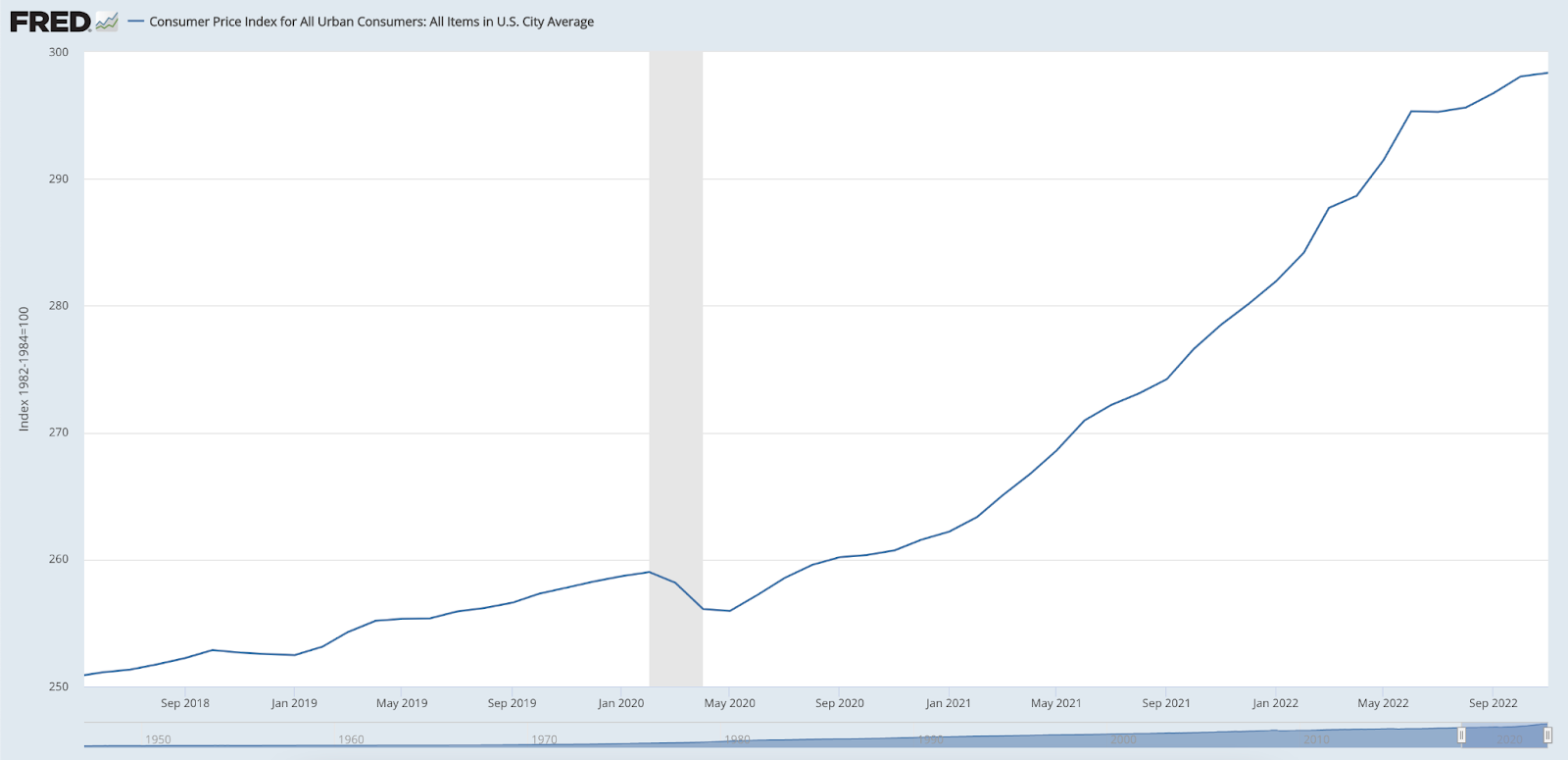

It’s common practice in crypto to utilize stablecoins to manage price volatility. However, despite the promise of stability in the name, holding on-chain dollars in a high inflation environment still causes purchasing power to erode over time.

Lemme get uhhhhhhhhh… nevermind.

Some counterplay exists- in a bull market, owning tokens gives exposure to growing markets, offsetting real dollar losses from inflation. In a bear market, widely owning tokens is not a great strategy, so it’s clearly not ideal for combating inflation. To effectively protect against inflation in a proper risk-off manner, you need a stable asset that fluctuates in price based only on an underlying inflation basket.

Frax Price Index

The Frax Price Index (FPI) stablecoin is designed to be the first on-chain stablecoin with its own unit of account derived from a basket of goods, both crypto and non-crypto. FPI is pegged to a basket of real-world consumer items, as defined by the US Consumer Price Index for All Urban Consumers (CPI-U). The underlying goal of FPI is maintaining purchasing power- as the price of items in the CPI rises, the price of FPI grows accordingly.

Like everything part of the Frax ecosystem, FPI is maintained through use of on-chain Asset Management Objects (AMOs). The stablecoin uses a specialized Chainlink oracle to pull CPI-U unadjusted 12-month inflation rate on-chain as soon as it is publicly released by the US Federal Government. This inflation rate is then applied to the redemption price of the FPI stablecoin in the system contract. The redemption price is updated on-chain every second, with the peg calculation rate being updated once every 30 days when the monthly CPI price data is released by the government.

When someone buys FPI stablecoins with another asset, like ETH, they are taking the position that the purchasing power of the CPI basket is growing faster over time than the value of the ETH they are selling. Conversely, when someone sells FPI stablecoins for ETH, they are taking the position that the value of ETH is outpacing the inflation rate of the US Dollar as represented by the CPI basket of goods.

The intention is for FPI to be used as a stablecoin to denominate transactions, value, and debt, and to help gauge the real-term value accrual of on-chain economics against inflation. The FPI stablecoin is also intended to help ground on-chain economics to baskets of real-world assets.

Frax Price Index Share

The Frax Price Index Share (FPIS) token is the governance token of the FPI stablecoin, and it is entitled to seigniorage, or excess yield, from the protocol. Inflation is taken into account when determining the value of FPI, and the protocol's balance sheet must grow at least at the rate of inflation in order to maintain a 100% collateral ratio.

FPIS is linked to the Frax Share (FXS) token, which is the base token of the Frax ecosystem. Both FXS and FPIS tokens accrue value proportional to the growth of the FRAX and FPI stablecoins. FPIS holders are entitled to a portion of the revenue generated by the FPI stablecoin, and FXS holders are entitled to a portion of the excess yield generated by the protocol. In addition, FPIS grants token holders governance powers such as voting over the methodology of how the CPI is calculated. This presents a pretty interesting scenario where FPI could be an independent measurement of inflation based on digital statistics (ex. Amazon.com, Cars.com, Zillow, etc.) instead of the traditional measurements that the government currently uses to measure the CPI.

FRAX’s balance sheet is made up of a variety of assets such as the FRAX stablecoin and potentially other low-risk crypto-native assets like bridged BTC and ETH, as well as non-crypto consumer goods and services. The protocol then uses AMOs to generate yield, which is then directed to the FPIS or FXS token holders as excess yield.

Source: DiligentDeer

The FPI stablecoin is designed to maintain a 100% collateral ratio, which means that the protocol's balance sheet must be growing at least at the rate of inflation in order to maintain the value of the FPI stablecoin. As such, the AMO strategy contracts must earn a yield proportional to the inflation rate in order to maintain the collateral ratio. If the AMO yield is not sufficient to keep up with the inflation rate, the FPI stablecoin may use a TWAMM AMO (Time-Weighted Average Market Maker) to sell FPIS tokens for FRAX stablecoins in order to maintain the collateral ratio.

At high levels of inflation, this results in the treasury having to organically fund 7+% annualized returns on FPI, which may not be sustainable. However, assuming CPI normalizes to a more manageable rate, FPI should offer investors a reliable on-chain way to protect assets from inflation risk and maintain value.

Future Functionality

In a world of complex on-chain functionality, FPI and FPIs are incredibly clear and simple tools for inflation protection. While basic use is simple: swap inflation-exposed assets for non-exposed assets, FPI’s true effect will be felt twofold.

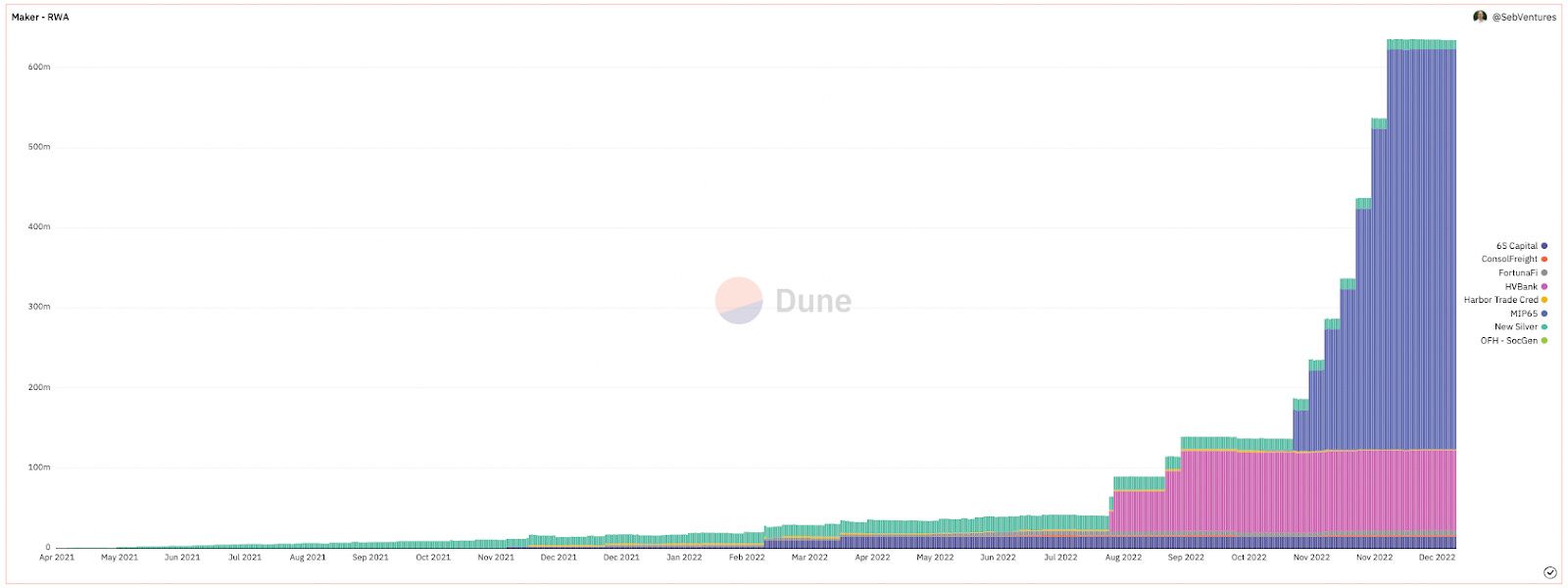

First, FPI enables growth of ‘Real World Assets’ (RWAs) within Frax’s ecosystem, tying the protocol’s on-chain monetary policy to changes in the real world. Increasing exposure to RWAs will allow Frax to reduce reliance on purely on-chain activity for sustained uptake, allowing use-cases in adverse market conditions. Other major DeFi blue chips like Maker DAO have been seeking to achieve the same, onboarding $500+mn of RWA assets from August - December 2022.

Maker RWA Growth - Dune

Second, FPI enables some creative yield strategies around inflation that were previously impossible on-chain. As an example, making full use of Frax’s ‘DeFi Trinity’. Let’s say that you’re an investor that wants to hold staked Ether, earning that sweet, sweet yield, but are also nervous about inflation and the economy. Finally, there’s a solution!

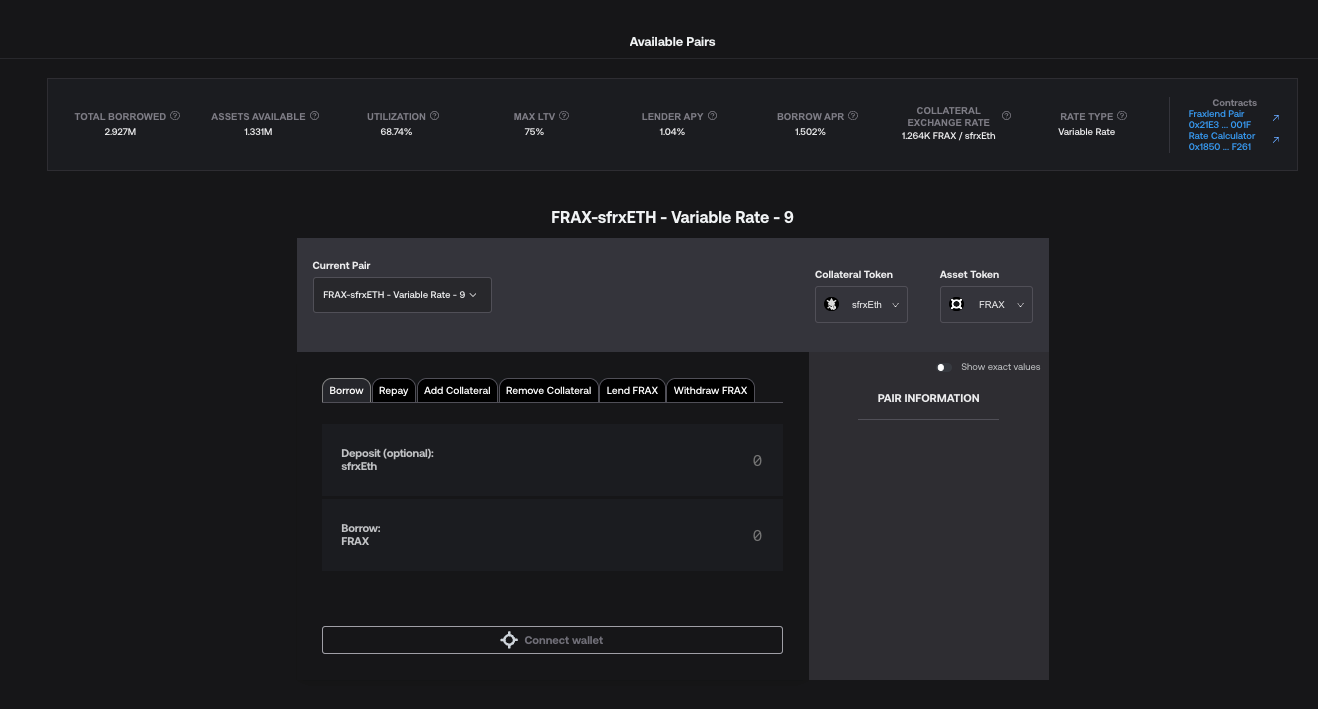

Through FraxLend, users can deposit sfrxETH (translated: Staked Frax Ether) and borrow FRAX against it at up to 75% LTV. The pair also has a 1%/1.5% lending spread, meaning that borrowing against your sfrxETH will only cost you .5% annualized (variable rate, subject to change). Worried about losing rebases? Don’t be- sfrxETH isn’t a rebasing token; the base price increases as it accrues interest, like rETH.

Now with stablecoins securely in wallet, it’s as simple as hopping over to the FPI minting page, where you can pay a .3% swap fee to mint FPI for your FRAX.

What’re we left with?

- Initial Ether Stack, staked and accruing ~8% APR at current levels, because of a creative liquidity mechanism.

- A .5% APR Borrow

- A .3% Swap Fee to Mint FPIS

- Up to 75% LTV in FPIS

This creative strategy has positive carry through Ether staking and current inflation, and has minimized downside through low cost to borrow. Potential risks are primarily around continued ability for Frax’s protocol revenue to sustain FPI’s peg, assuming inflation remains high.

Assuming 7% inflation, annualized, and 60% LTV, you could boost Ether staking yield to:

= Staked Ether APR + (7% inflation * 60% LTV) - (2x Swap Fee + Net Borrow Fee)

= 8% + 4.2% - 1.1%

= 11.1% Total Theoretical Yield

Wrapping it Up

While there’s no doubt that a number of creative strategies utilizing this tech stack will be discovered in the coming months, FPI is clearly an exciting development for everyone from investors looking for inflation protection to protocol magnates looking to create optimized yield strategies.