Hello Mrs. Cathie Wood,

Over the weekend, I watched your interview with economist Arthur Laffer, where you were trying to extol the virtues of Bitcoin to him as a store of value and digital internet gold. Just over 30 minutes into the discussion you asked Mr. Laffer a question about bitcoin in response he said the following:

The one thing that always bothered me about Bitcoin and all these other cryptos, and forgive me for this, is why don't they find an algorithm that guarantees the value of the unit and lets the quantities vary rather than controlling the quantity of the unit and letting the price vary.

People care about price stability over the long run. Yes. When I make a contract with someone for 20 years out, I wanna know what the value of the unit numeraire is gonna be back then. Not the quantity of it. I wanna know the value of it. And why can't these little geniuses, all these people with computers, I have a flip phone.

Why can't you guys find some cryptocurrency that has a stable value rather than a quantity, fixed quantity, and that's what just bugs the live and poop outta me about these cryptos. They need a value crypto, not a quantity crypto.

Immediately, upon listening to this I fired off a quick tweet.

Now that I have more time after the weekend, and I don't have to look after my kids. I wanted to spend a bit more time to explain Frax and its inflation pegged stablecoin FPI.

FPI or Frax Price Index is the first stablecoin “pegged to a basket of real-world consumer items as defined by the US CPI-U average.” The goal of FPI is to maintain a stable price to a basket of consumer goods and thus hold its purchasing power in the exact way that Mr. Laffer described. FPI has been operating for a year and has been able to track the CPI average perfectly during a time of high inflation.

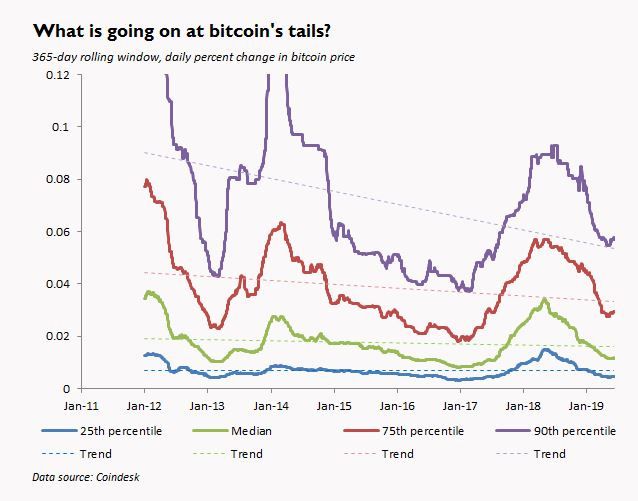

Before diving into FPI, I just want to note that I believe it's folly to assume the price of bitcoin will become less volatile in the future. One of my favorite writers, JP Koning, has done some excellent analysis on bitcoins price volatility, showing that while bitcoins volatility, and the extremes has declined, its median volatility has remained the same ever since launch. And there's no reason why it should ever decline, as it's a fixed supply asset with a low float and zero "fundamental value."

You refer to Bitcoin as both a money and also an investment. It is able to transfer value, but its value is highly volatile. Bitcoin is a "suboptimal" commodity money as a result. More so, its bad for finance, as it's difficult to draft any type of contract in bitcoin that would project future prices. It's also extremely difficult to imagine large amounts of loans being taken in bitcoin due to its price volatility. Who in the right mind would want to take a loan that could potentially grow in size 20 times by the time it's term ended.

Bitcoin alone is just not enough. Demand for fiat money is always going to exist, and it will only grow as bitcoin grows, as fiat money is the best money to take loans with. I wholeheartedly doubt that will ever be able to discharge debt-based fiat money for some alternative, even with all of its unsightly deficiencies. Our greatest fear though, should be a monopolization of money into one single type. Until Bitcoin came along, Cash was the best check against unfettered monetary incursions. Now, Bitcoin also falls into that same roll, simultaneously adversarial and beneficial. Ultimately, Bitcoin does one thing well, which is to be an immutable means of payment on the Internet.

I'm just a crypto pleb, and so what I know about economics is mostly derives from Twitter and other random places on the Internet. But what I have been able to gather is that economists think in terms of maximizing the capabilities of individuals and businesses to make rational choices about their future consumption. We need to be able to say with moderate certainty, a defined basket of goods or cost X today, and probably Y tomorrow. If everyone believes this, then it typically happens. It's honestly the strangest thing about economics to me. Everyone talks about inflation, but nobody really understands how it works. There's a deeper level of human psychology, underlying economics, obfuscating, logical outcomes. It's so weird that price increases can become anchored, and that no matter what a government does, or says, people just keep on marking prices up without explanation.

Honestly, the entire system is crazy; we have an ever-expanding federal government that desperately is in need of buyers for its debt. Without them, they wouldn't be able to fund any of their operations. To drive demand, they devalue the base currency just a little bit each year and incentivize conditions within commercial banks for private entities to take new loans that hopefully benefit the economy long-term.

It's hard to think about what money would be like if it was disconnected from government. The MMT people naturally assume that money is just a tool the state, that needs to be regulated and controlled. I don't even know if we can imagine a world anymore with an independent money. Maybe this is why the dream of crypto is so alluring. To be able to return to a fable time, a libertarian fantasy, where the state is the functional output of a representative class. Maybe we just take it for granted, the power of the purse and government’s monopoly on it. We don't really have any viable alternatives to compare and so we're forced to dream of various crypto Ponzi's hoping one finally achieves this vaunted goal.

Bitcoin has been able to build a system of money that is completely independent of any government or existing monetary order. It is not captured politically. It is not a tool controlled by anyone. And it makes no assumptions about pricing power or stability. It's just code that anybody can run. Simple.

As soon as you move away from this model, towards connecting real life with immutable assets, there are trade-offs that have to be made. Governments are ruthless when it comes to control of their monetary monopoly. Wars have been fought over who will have the right to print. Today, we face these challenges again as stablecoins are pushing the boundaries of what digital money can be.

The idea that Mr. Laffer put forward tries to thread the needle between the current form of the dollar and a bond. Both monetary assets have a value, and they're also guaranteed with the full faith in force of government. However, these assets are easily devalued and rely on the steady breeze of political winds to maintain course. It’s antithetical to the current monetary system to guarantee a fixed value over an extended period of time. It wouldn’t make sense for the government to issue this type of money that tracks, inflation, or a basket of goods, because the monetary authorities must preserve their ability to issue a new specie whenever they didn’t fit. When they do issue inflation protected assets like Treasury Inflation-Protected Securities (TIPS), there are strict limits on how much can be bought and high fees for redeeming early.

The closest form that we have to this inflation targeting money in traditional finance, are money market funds. And while they might be a cash like substitute, their values can waver in times of market stress, like during 2008 or 2020. When investors lose faith in the ability of the short term bond market to maintain liquidity money market funds have lost their peg. Additionally, money market funds are a security, making him an extremely poor substitute as a daily payment currency.

We need a better solution. Enter FPI by Frax.

Like I mentioned above, FPI is an inflation tracking stablecoin.

FPI works pretty simply. You swap your FRAX stablecoin for FPI and the protocol goes out and figures out the best way to earn yield with it. Frax deploys collateral using Automatic Market Operations (AMOs), into a variety of different on-chain protocols and applications across a variety of networks.

It then uses the CPI-U number provided by Chainlink to adjust the FPI peg up or down over the course of a month after its officially released each month. In the future, the idea is to use on-chain voting to determine what’s in the basket of assets its tracking and also its value.

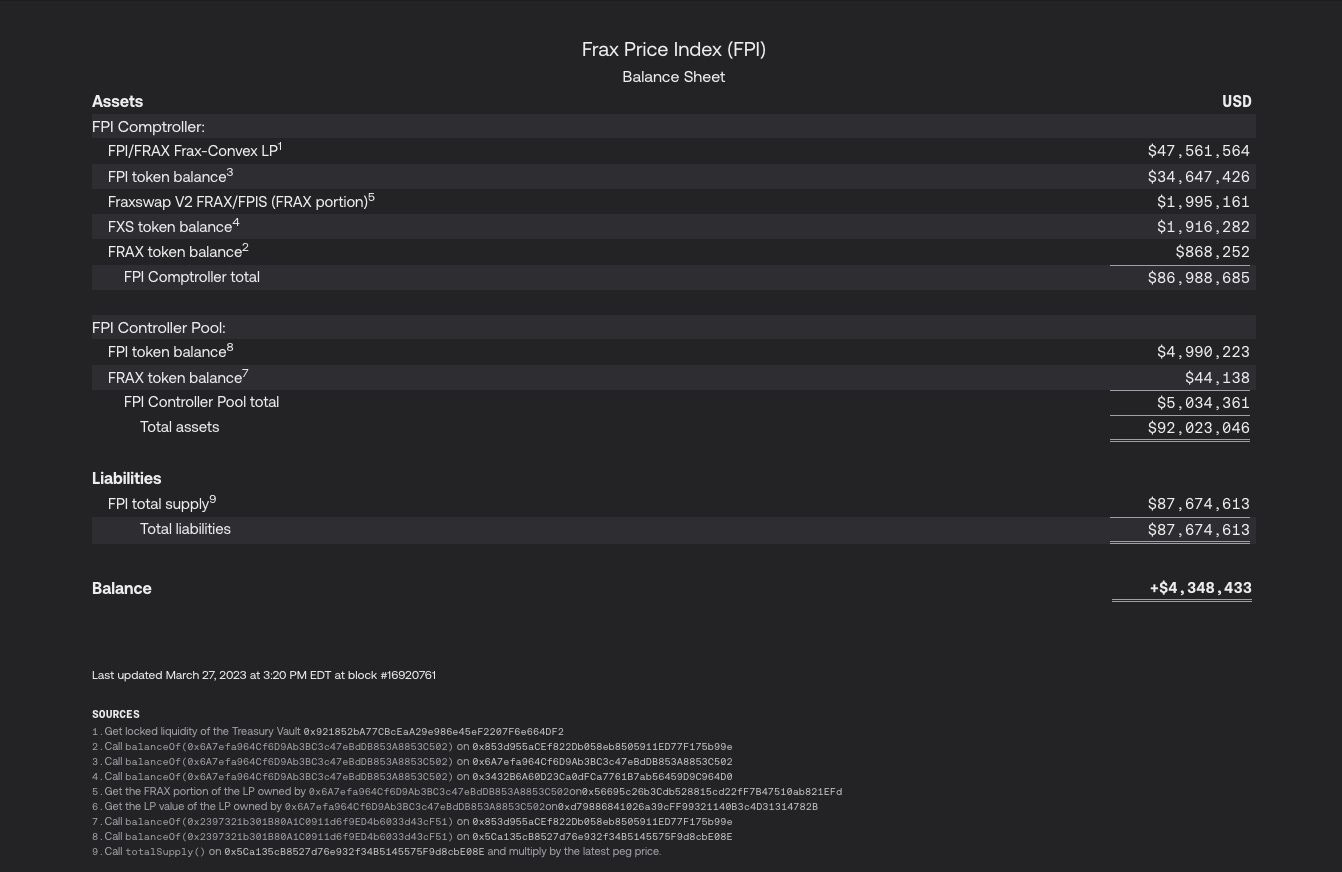

As long as Frax can earn a higher amount of yield than inflation FPI will work in the long term. To handle periods of high inflation or when the protocol cannot earn enough yield, FPI has a buffer of reserves that can be drawn from. Currently, there is an excess of $4.4m held by the protocol.

One of the great things about crypto and Frax is that all of our assets are on-chain, thus visible and transparent. The Balance Sheet above shows numbers in real-time, up to date with the latest block. No other money type can do that with such clarity.

FPI isn’t perfect. You might earn better yield keeping your cash in a MMF. A wave of high inflation might bankrupt the product. Or maybe, Mr. Laffer’s dream currency won’t ever be used by the general public. It’s too early to tell.

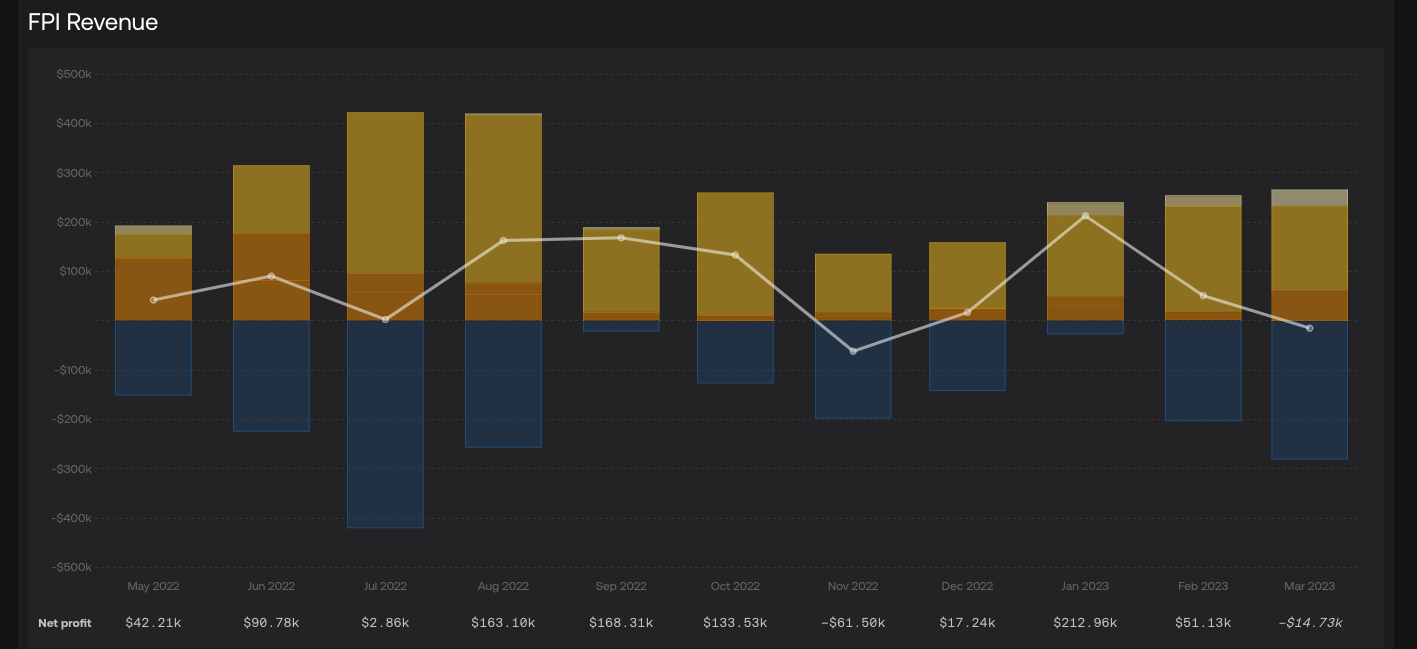

We can say though for certain that FPI exists, its maintained its peg since launch, and Frax has profited from operating the product almost every month. When the hard cap of $100m is lifted later this year we will see if it can handle the expansion, but I do think the pegged can be maintained at size.

Additionally, FPI is an ERC20 token already integrated into DeFi. Any new developer can seemlessly build FPI into their product offering. FPI is now a core primitive to the future of crypto and DeFi. We expect that it will grow into the billions in the next years and are eagerly watching its growth.