Stablecoin rating agency Bluechip launched its rating system last week to a mixed reception of reviews. The non-profit organization is trying to provide transparent and data-driven evaluations of all stablecoins on the market.

Bluechip arose out of the same circumstances that brought about Flywheel. In the wake of Terra/Luna’s collapse, Chief Economist Garett Jones came to understand that “many people who were using stablecoins were unaware of risks that were obvious to many experts.” For anyone who had gambled on the myriad of algorithmically backed stablecoins like DSD, ESD, and Basis, it was clear that the model didn’t work. Only after the complete ravaging of the protocol did the entire system collapse, bringing down FTX, Celsius, and a bunch of bad actors with it. Jones says “People who want a safe, legal, and easy way to make and receive payments, but aren’t experts on monetary economics, need a simple tool and a clear grading system so they can decide which stablecoins to use.”

We agree with him. We needed better transparency in the wake of UST’s collapse. Billions of dollars of paper wealth was lost in a few days, with many losing their life savings. UST had been marketed as a “stablecoin,” an instrument that should retain its $1 backing no matter the market conditions. UST’s addition to the “pristine” asset category was extremely shortsighted and dangerous. Many businesses leveraged the perceived safety of UST to funnel dollars from people’s savings into Anchor, the yield product built on top of Luna that was providing 20% interest.

What is Bluechip?

Bluechip is a stablecoin rating agency that uses a proprietary, open, transparent rating system to assign grades to all major stablecoins to help investors navigate risks.

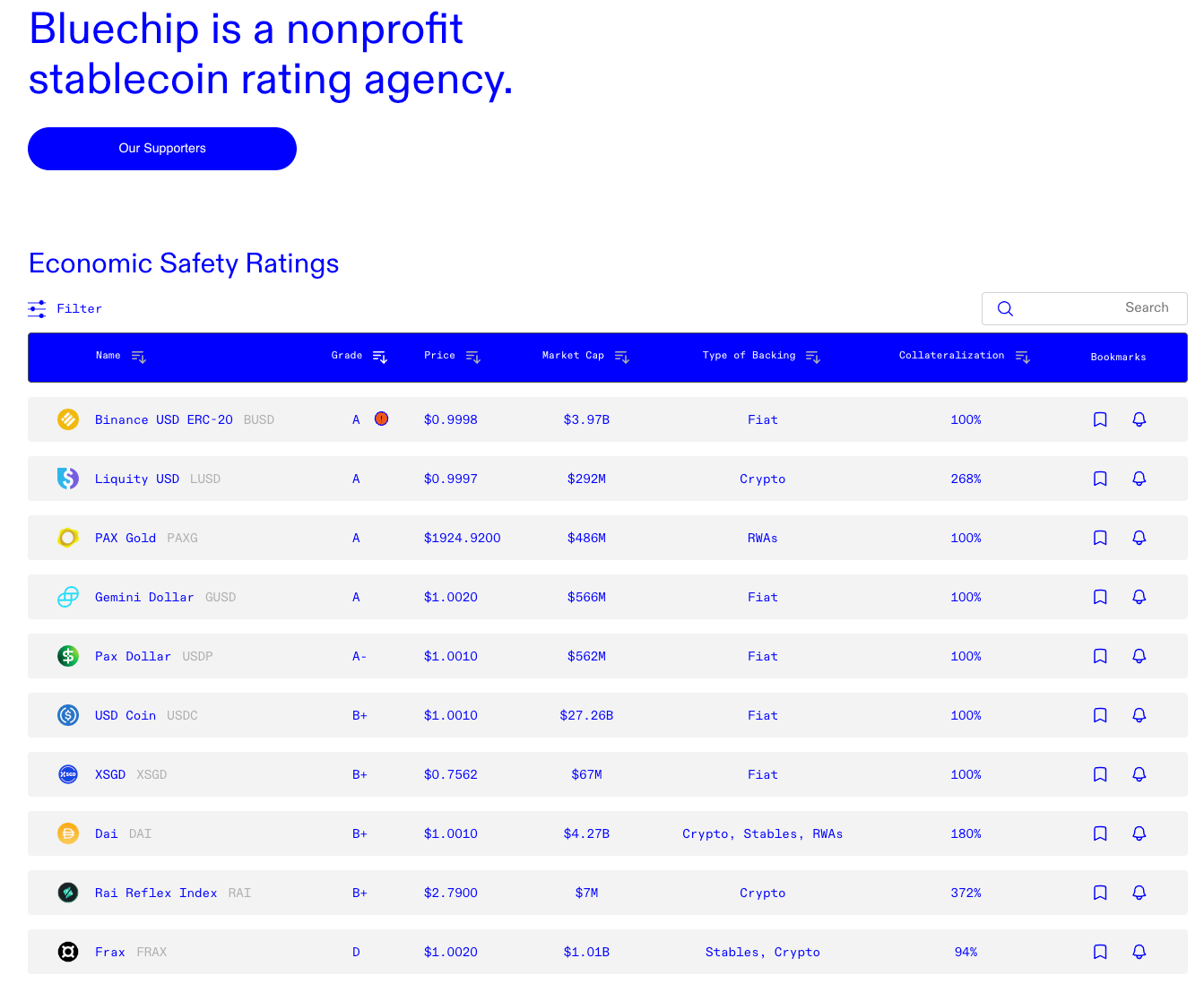

Bluechip started with ratings for 15 stablecoins (and 2 gold-backed tokens). These are Binance USD (BUSD), Liquidity USD (LUSD), Pax Gold (PAXG), Gemini Dollar (GUSD), Pax Dollar (USDP), USD Coin (USDC), XSGD, Dai (DAI), Rai Reflex Index (RAI), Frax (FRAX), Tether Gold (XAUT), Tether (USDT), Euro Tether (EURT), TrueUSD (TUSD) and USDD.

BUSD, LUSD, PAXG, and GUSD all received A ratings. USDD was the only stablecoin with an F rating. Frax received a D.

Unpacking Bluechip’s SMIDGE Rating System

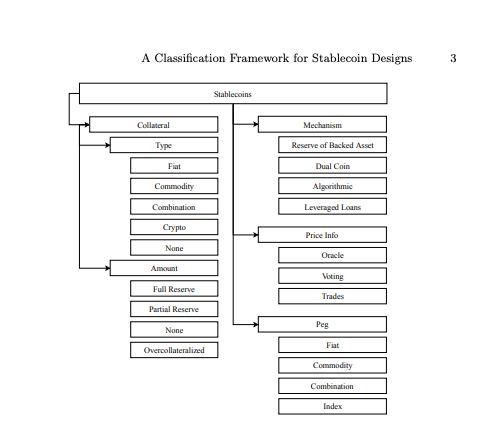

All of the listed stablecoins are rated based on Bluechip’s self-designed rating framework SMIDGE: Stability, Management, Implementation, Decentralization, Governance, and Externals.

We will come to Stability last since it's been the most contentious.

Management

Reviews the team and structure behind the stablecoin. Bluechip looks at if the team is anon, their background, incentives between stakeholders, compensation, and token allocations. Interestingly, it also looks at legal jurisdiction and judges it against the World Justice Project’s Rule of Law index and the World Bank’s World Governance Indicators. The rule of law is important for judicial recourse in case of any fraud or malicious behavior.

Implementation (Not Currently Used)

Created mainly on-chain actors who use smart contracts for issuance, redemption, and stabilization of their stablecoin. It examines key aspects of a stablecoin’s security, testing, and operational standards. These include the quality, scope, and outcomes of smart contract audits, particularly how identified issues have been addressed; the level of code testing done by the project team and the outcomes of these tests; the extent and control measures associated with administrative privileges, specifically protective measures against misuse; and lastly, the project's history with vulnerabilities and exploits, assessing the frequency, the financial impact, and the team's response to such events, including user compensation efforts.

Oracles are a large part of the Implementation score, as they are the weakest link in DeFi. This includes evaluating the freshness and accuracy of the data, the breadth of market coverage, redundancy measures to prevent single points of failure, and incentive mechanisms to maintain data integrity.

Decentralization

It is about more than just censorship resistance, it's about looking at control over the issuance, governance structures, methods of asset storage, and the ability for stablecoin holders to transact without relying on a trusted counterparty. The score looks at whether the Feds can rug the project themselves, blacklisting, custodian risk, collateral types backing the stablecoin, and DAO structures.

Governance

Evaluates the org structures, companies, DAOs, etc… and how they maintain price stability and other malicious actors that would seek to destabilize the stablecoin. Some stablecoins have massive on-chain treasuries that could be at risk of rugging if token holders voted a certain way. What steps does a DAO take to prevent loss of funds? For off-chain structures, the rating looks at what legal protections and redemption and verification methods are available.

Externals (Not Currently Used)

Integrates external market and social sentiment, using market prices as indicators of risk and safety. They specifically focus on three types of markets: perpetual futures markets, stablecoin prediction markets, and credit default swaps (CDS). Perp markets are the most interesting indicator and predictor of future stablecoin prices. They are highly visible markets with deep liquidity. Bluechip pulls live, real-time data for analysis.

Stability

For Bluechip, it’s not about how stable a stablecoin is, rather it's a function of its peg mechanisms and reserve makeup. It’s a broader parameter that looks at the resiliency of a stablecoin. It looks at three broad factors: collateralization, peg stability, and mechanisms.

Collateralization evaluates both the collateralization percentage and the type of collateral. Stablecoins that are backed by safe, liquid assets, such as government bonds or fiat currencies, are generally deemed more stable and thus receive higher scores. On the other hand, coins backed by highly volatile assets require a significant level of over-collateralization due to inherent risks. Additionally, collateral safety and segregation are also a part of this score.

Peg stability reviews historical price data, looking at the frequency and magnitude of deviations from the peg, daily volatility, and the stablecoin's behavior during market downturns.

Lastly, the core mechanisms that operate the stablecoin, such as unrestricted minting and reserve redemptions (arbitrage), borrower incentives in loan-backed systems, manipulations through interest rates and fees, open market operations by the issuer, and the use of seigniorage shares & bonds are all reviewed.

Deathereum Enters the Chat

After the site went live and the community had time to dig into the docs, the stability rating quickly became the most contentious item of discussion in the Frax chat.

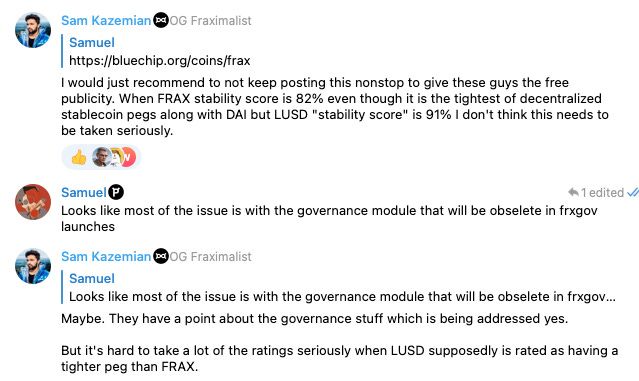

I think that if they had given this term a different name, there probably would have been less reaction to it. Sam K was not impressed at first.

Notably, LUSD was the highest rated decentralized stablecoin in Bluechip’s rating system.

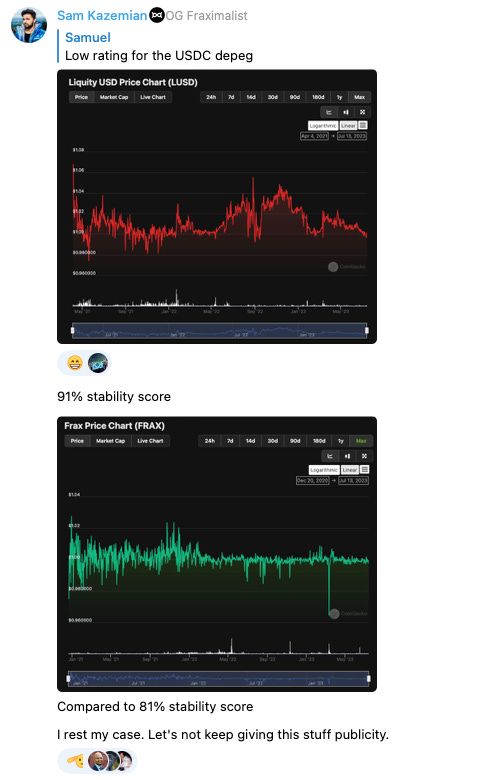

Sam Kazemian took umbrage with the stability rating as it seems only to penalize downward price movement, and not upwards. Deviation below the peg is much more highly penalized than breaking upwards. Additionally, while daily volatility is taken into account, it’s a small part of the overall score. Kazemian thought this was “dubious to say the least.”

At this point, Bluechip contributor Deathereum, the Ratings Director of Bluechip and the person who formulated the SMIDGE rating framework said in the Frax chat that Stability is “more than just price stability” and that it's “broader in scope than what those two pictures portray. It’s not just about what price has done, it’s mainly about what factors we think contribute to overall long-term stability.”

Deathereum then stated about LUSD “When I said I don’t view LUSD as a strictly fixed-peg coin, I followed it up with a statement that it is still measured as one. I do not use a different benchmark for LUSD and other dollar-pegged stablecoins. LUSD’s high stability score is largely a function of its mechanism and reserves.” Kazemian agreed about the strength of LUSD’s collateral makeup, but said he “just can't take seriously… [that] a reasonable person would think the concept of ‘stability’ means [LUSD] has much better stability when discussing stablecoins.

Kazemian went on to say “your definitions are questionable to say the least and misleading to be blunt.”

At this point other Frax community members started commenting. Convex Founder C2tP wrote “Saying that lusd is stable, is against the very term of a pegged asset though. It's actually the least stable of all main stable coins as it's almost always traded above what it's supposed to be. People who take loans get rekt by depegging on the upside. Dai had this problem too. But it's a lot more stable now after things like psm were made.”

Friend of Flywheel and Vesper Finance Founder Green Jeff wrote “Vesper doesn't convert TVL to LUSD LP for yield because we don't have enough confidence around the peg, it fluctuates many bp north of $1.00 any given day. (whereas FRAX we do use for LP confidently)”

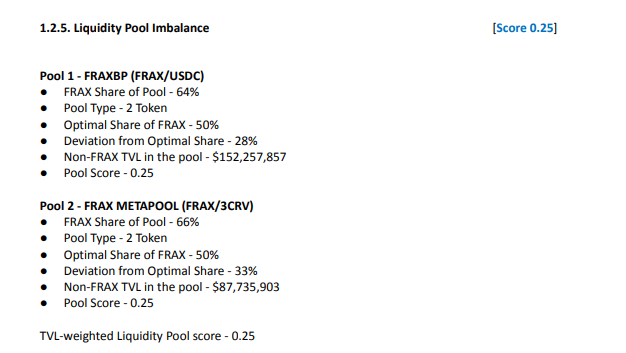

Liquidity Pool Imbalances

Another contentious issue from the Bluechip report was how they rated Frax’s liquidity makeup. They gave FRAX a .25 for its liquidity imbalances in FRAXBP and FRAX3crv.

Jefe ElJefe responded to this rating with some clear thoughts regarding the AMO’s.

He said:

Liquidity pool balance is almost meaningless when applied to FRAX. 760 million of the Curve liquidity is owned by protocol and FRAX can be added or withdrawn automatically by the AMO. The parameters are set to be super flat pool. Can think of it more as a pool of available to buy frax or a pool of available to buy USDC. The AMO will allow what you might call an imbalance but it doesn’t mean anything about the peg stability or solvency of the protocol.

You’d be better off testing what percentage of outstanding stablecoin can be sold without significant slippage. That is much more meaningful that the pool’s balance.

Frax’s curve AMOs allow massive flows in either direction without slippage which is one reason it will always be very tightly pegged.

Selling 280 million frax causes same percentage depeg as selling 10 million LUSD

Can only buy about 5 million LUSD without any loss… you can buy 200 million frax for 200 million usdc. It’s available liquidity and thus stability compared to LUSD is MAGNITUDES larger.

And this is despite the fact that outstanding LUSD is actually probably pretty similar to outstanding frax( because most of the frax TVL is actually protocol owned)

This is one reason why people that understand FRAX think your stability ranking is bonkers. What is more important to a stable coin than available liquidity to be able to spend or buy said stable at $1 of value?

Imagine you are a whale that wants to borrow $30 million against eth. If you use LUSD, your 30 million loan can only be used to purchase 9 million usdc(or other assets)… it’s unusable at size without TWAMMing out.

I like Liquity, as do most defi people it seems, but LUSD stability, and utility as a stablecoin are a minuscule fraction of frax’s

Deathereum responded that he thought that these were good points to take into account and that they would update their model to analyze AMO funds deployment.

However, he continued to state that Bluechip has a different definition of stability than available liquidity.

Deathereum writes “The only reason FRAX can maintain such a tight peg is because you use other fiat-backed coins. Try doing that with volatile collateral. Both FRAX and LUSD have unique design choices which have inherent trade offs. FRAX’s peg stability comes at the cost of collateral quality. LUSD’s resilience comes at the cost of peg noise. It’s also worth noting that no stablecoin has to fulfil every single use case. So you’re really comparing apples and oranges.”

And he continued “A stablecoin can be more than a medium of exchange. It can be a store of value too. Pick your use case, pick your stablecoin.”

STABLECOINS?! WHAT ARE THEY GOOD FOR?

This is an interesting point Deathereum makes, which I think might get lost in this whole discussion. We’re so used to viewing money as a One-Type-Of-Money-Illusion that all dollars are the same. They aren’t and it’s a gross misconduct of our institutions and businesses to promote them this way.

A dollar is not a dollar. Dollars can be many things, cash, coins, debt, treasuries, FRAX, LUSD, USDC, but there are clear differences between all of them that make money extremely complex, but appear simple. Most of the issues around money come down to who pays for what and who is responsible when SHTF.

Money has three purposes, store of value, medium of exchange, unit of account. But there is a fourth functional responsibility which we often forget and take for granted, and that’s redeemability at par on demand. This is the ability of the redeemer to use the stablecoin for its intended value whenever they want.

LUSD by design prioritizes decentralization over peg stability. It’s goal is not to remain $1 at all times, but to provide a novel way to create debt from ETH. It’s “stablecoin” in the sense that its debt issued against a collateral asset, but its not “stable” enough for daily usage.

There’s are a myriad of different reasons to hold/mint stablecoins. Storing value is one, trading and leverage another, issuing trustless debt yet another… the list goes on.

I think the primary issue being raised from all of this Bluechip discussion is a debate between the functional operation and legal/reserve backing of a stablecoin. Bluechip firmly prefers stablecoins where all reserve assets in custody are transparent, segregated, and can act as pristine collateral. How the assets are used in day-to-day life are less important, everyone will have their own use case. Their main goal is to prevent retail users from losing money. Protocol, structural, contract and legal risks are potentially universalizable across all stable assets though and this is where the ratings system evolves from.

Bluechip sums up what they are trying to achieve in the conclusion of their Framework document:

As our framework evaluates stablecoins on multiple factors, trade-offs between factors are inherent. The implication is that there can be no single best stablecoin, but there are bests for specific use cases and user groups. While our grading scale will assign an A+ (highest in overall safety) to those stablecoins which have very low risk scores on multiple factors, thus prioritizing the 99% of stablecoin users, it is possible for other stablecoins to have spikes in only one or two factors and yet be the most appropriate for a particular user group. For example, a highly decentralized but reasonably stable stablecoin with a B+ grade would be more attractive to a decentralization/privacy focused user than the most stable fiat-backed stablecoin that held an A+ grade but was more centralized and had slightly weaker privacy protections. We expect our ratings to empower every user, advanced or otherwise, to make an informed choice based on their specific needs.

Kazemian concluded his stance “The reason I am fixated on the extremely unorthodox/dubious stability portion is because I actually WANT the Bluechip rankings to be something I can take seriously. I want to be proud of Frax's score when the governance portion is up to spec. But it's hard to take it seriously and care about the rankings when the other portions are egregious while the governance and other portions are reasonable and fair.”

It’s important to remember the circumstances that led to Bluechip’s creation, the utter and complete destruction of LUNA/UST that led to billions in losses across the entire sector. The functional operations of the world’s largest stablecoin ceased to exist in a matter of days due to the poor resilience of their reserves. Just recently, USDC experienced a depeg due to poor asset custody at Silicon Valley Bank. So it’s not like what Bluechip is building is without external negative impetus. There are a lot of bad actors in the crypto space and their collapse leads to serious consequences for those people who trust their assets with them.

We need more Bluechip’s in the space to provide greater clarity and transparency. We need rating systems to help all actors to better understand the risks of what they are swapping their money into. We need defined guidelines as to what makes a stablecoin good. And so while the discussions coming from the Frax community might seem tense, it’s only because we believe we have valuable insight into what good stablecoin metrics are and would like to be apart of the conversation. We applaud the Bluechip team for their work and hope that this is just the beginning of their analytical development.