In this week’s episode, we had on a fourth time Frax Finance Co-Founder Sam Kazemian, who gave an in-depth interview on the upcoming deployment of frxETH v2 as well as some hints on what we should expect from Fraxchain. Flywheel has covered FrxETH v2 in depth and you can catch up with our explainer guide.

Kazemian’s Thoughts on frxETH

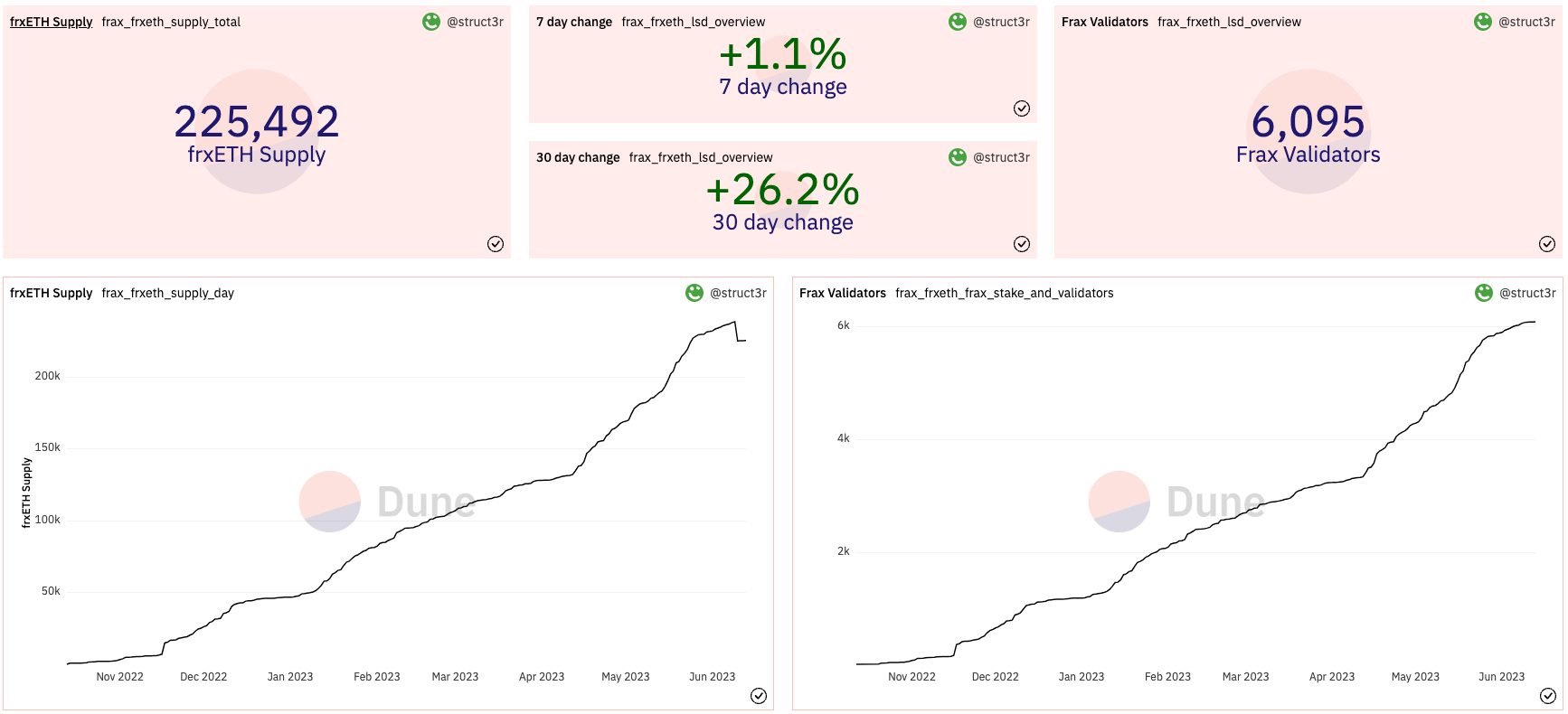

According to Kazemian, frxETH v1 has “come a long way objectively,” and is “currently the fastest growing LSD in history.” In just 8 short months, frxETH saw tremendous growth, growing to 238,000 at its peak. While the recent market selloff recorded the first outflows, overall its success is undeniable and showcased yet again how Frax’s AMOs can safely maintain peg in times of retraction.

One of the reasons frxETH v1 has grown so fast is that Core Dev team understands the importance of running high performing systems possible. Sam K said that frxETH validators boasts the highest overall rating on rated.network, as well as the highest 30 and 7 days rating, that measures uptime, rewards earned and more.

When designing frxETH v2, Sam K was faced with two key questions. The first question was how to choose the best entities to run nodes if everyone can run one. Sam K wanted a market mechanism that would prioritize “the most performant, sophisticated, and knowledgeable entities that know how to run good nodes.” This market mechanism could be based on several factors, including “MEV revenue, lowest hardware costs, highest internet speed, block propagation, attestation responses,” and more.

The second question that Sam K wanted to answer was how to reduce the capital costs associated with decentralization. When you fully decentralize and don’t KYC or attach IRL reputation to node operators you have to ensure there is some collateral on-chain acting as a bond. This prevents node operators from acting maliciously, but it lower the capital efficiency of the protocol, and as a result, the reward yields suffer. Some networks even require a worthless governance token to be used as a bond in addition to ETH, further reducing capital efficiency.

The end result is frxETH V2, that redefines what it means to run a node by creating a fully trustless lending market between ETH stakers and node operators. Sam K explains that all Liquid Staking Derivatives (LSD) are essentially "lending markets." They operate in a similar fashion to lending platforms like Fraxlend or Aave where users can deposit collateral and borrow something in return.

For example, when someone deposits ETH into Aave, they receive aETH back. In order for someone else to borrow the deposited ETH, they must first deposit their own collateral. Once they take the loan, they pay an interest rate based on the utilization function.

With frxETH v2, node operators deposit ETH as collateral in the smart contract, they then can borrow ETH supplied to the lending market to run a validator. As long as the node operator pays the interest rate, the frxETH loan can remain open, similar to Aave. Connecting to the existing frxETH v1 system, the sfrxETH yield is the dynamic interest rate paid by the node operators borrowing the ETH to stake.

Sam said “If you treat it like a lending market [frxETH v2 is] basically the most efficient LSD protocol because everyone that is good at running a validator will want to borrow our ETH” at the lowest rates.

The cool thing about frxETH v2 is not only will it have the most competitive rates, but additionally, Sam K thinks that only 4 ETH will be needed to post as collateral to borrow 28 ETH. Rocketpool, a competitor, requires 8 ETH plus an additional bond of RPL. This makes frxETH v2 “twice as efficient.” While this does raise slashing risks, veFXS holders will eventually have to make that decision.

Fraxchain, Fraxtal, or Fraximalism?

Sam Kazemian dropped some fresh alpha regarding the future release of Fraxchain (name TBD, the episode featured DeFi Dave and Sam going back and forth on whether to name it Fraximalism (like Optimism) or Fraxtal (pronounced “fractal”)). He stated the upcoming L2 is set to launch by the end of the year and that the team’s really been focused building a truly innovative solution that benefits the protocol, rather than just launching the 200th EVM based rollup. Sam said that it would use frxETH as gas.

Fraxchain will be designed as a “hybrid-rollup” that uses frxETH as gas. As people use the system, frxETH would be burned for transactions, which can be distributed to veFXS holders. veFXS also will get to vote on which entities or addresses can operate the sequencer batches and push proofs to the Fraxchain rollup contract. Sequencers can even auction their services, paying veFXS holders, creating a brand new bribe market. Sam thinks this could be very profitable for the protocol; Arbitrum is currently making millions in fees

Account Abstraction

Sam K said that account abstraction is interesting because it allows for a host of possibilities, such as smart contract accounts, gas abstraction (gas does not need to be paid and can be outsourced) and social recovery wallets. The Core Dev team is currently researching the subject on potential use cases.

For example, if all the accounts on Fraxchain at genesis can actually be smart contract accounts, the whole ecosystem could use account abstraction. Sam notes that it's difficult to transition from EOAs, which everyone uses, to smart contracts where everything is account abstracted for account-based systems. In this system, Fraxchain would be a “fully programmable bank account.”

Sleeping on Frax

At the end of the episode, Sam gave his thoughts on recent market conditions, saying that “people are sleeping on what’s to come for Frax.”

frxETH v2, BAMM, Frax v3, more decentralized, self-serving FXS gauges, and a new staking system are all in the works.

veFXS holders will should see a ton of new income streams coming online soon: equencer auctions, BAAM trading fees, lending and borrowing fees from FRAXlend, frxETH V2 protocol fees.

Sam thinks the protocol is growing a “global economy” one step at a time and that it will eventually become all-encompassing and unstoppable.