As we’ve worked to lay out in our first and second pieces, driving organic, fundamental, and sustainable demand is the single most important driver for long-term stablecoin success. Everything else- from tokenomics to yield, is frills on an underlying model.

At their core, stablecoin issuers are central banks with the goal of issuing currency at the same rate as demand grows. Success is measured by a protocol’s ability to grow their balance sheet while keeping the stable pegged to a dollar.

Last bull market, there was an influx of new stablecoin mechanisms, each claiming some important new technological innovation. However, the vast majority were poorly structured businesses where each subsequent stablecoin minted actually increased unhealthy protocol debt. So, clearly, stablecoin minting must come secondary to sustainable financial practices.

If not through artificial yield, how can an issuer drive demand for new mints? The solution may just lie in lending markets. Enter Fraxlend.

What is Fraxlend?

Fraxlend is an over-collateralized, permissionless platform that creates lending markets between any two ERC-20 tokens with Chainlink feeds. Like Sushi’s Kashi, each pair is its own immutable and isolated market, which dramatically decreases cross-pool contagion risk.

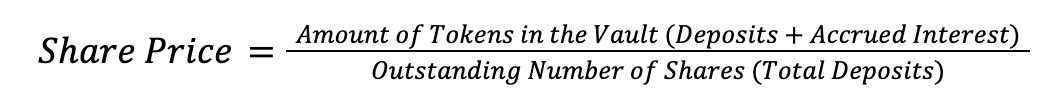

Lenders deposit tokens into the instantiated pair, and receive an equivalent ‘fToken’. The fToken is a yield-bearing asset that represents a pro-rata claim to assets in the pool. As interest accrues on the pool through borrowing activity, the Share Price of the fToken increases. Withdrawing assets from the pool redeems the fToken for a share of pool assets that is always equal-to-or-greater than the starting amount, as pools are both over-collateralized and accruing interest.

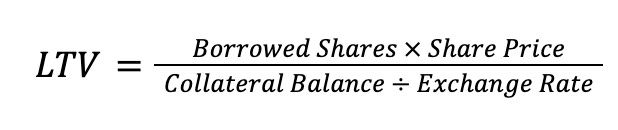

Borrowers provide collateral to pairs, and are able to take on debt up to a maximum Loan-to-Value amount set by the deployer (LTV). Borrowing assets from the pair carries interest, which is variable and based on the total utilization of lent assets in the pool.

Mechanics

The base isolated lending mechanisms of Fraxlend are battle-tested, but have some unique features that should help attract users.

Lending Mechanics

For lenders, there are two primary concepts: fTokens and Vaults. Vaults are the core accounting mechanism for pairs, and track both the amount of assets in the pool, as well as the total outstanding claims to the pair.

Each fToken represents a number of ‘shares’ equivalent to the value of deposited assets. The exchange rate of fTokens for pair assets is variable, and based on the amount of interest accrued to the vault since deposit. That means that current Share Price can be calculated at any time by dividing the Amount of Tokens in the Vault (read: Market Cap of the pair) by the outstanding total number of Shares (read: Total Value of Lent Assets).

Borrowing Mechanics

Borrowers have two major focus variables: LTV and Interest Rate. Each pool has a Maximum LTV of 75% for permissionless pairs that is immutable and set upon deployment. If the ratio of a borrower’s debt to their collateral rises above Maximum LTV, the position becomes unhealthy and can be liquidated.

Liquidated positions are repaid on the borrower’s behalf in exchange for an equal value of collateral, plus a liquidation fee that is immutable on deployment, and set to 10% by default. As debt accrues interest over time, borrows can become unhealthy, meaning potentially active management of positions, through addition of collateral or repayment of debt, is important.

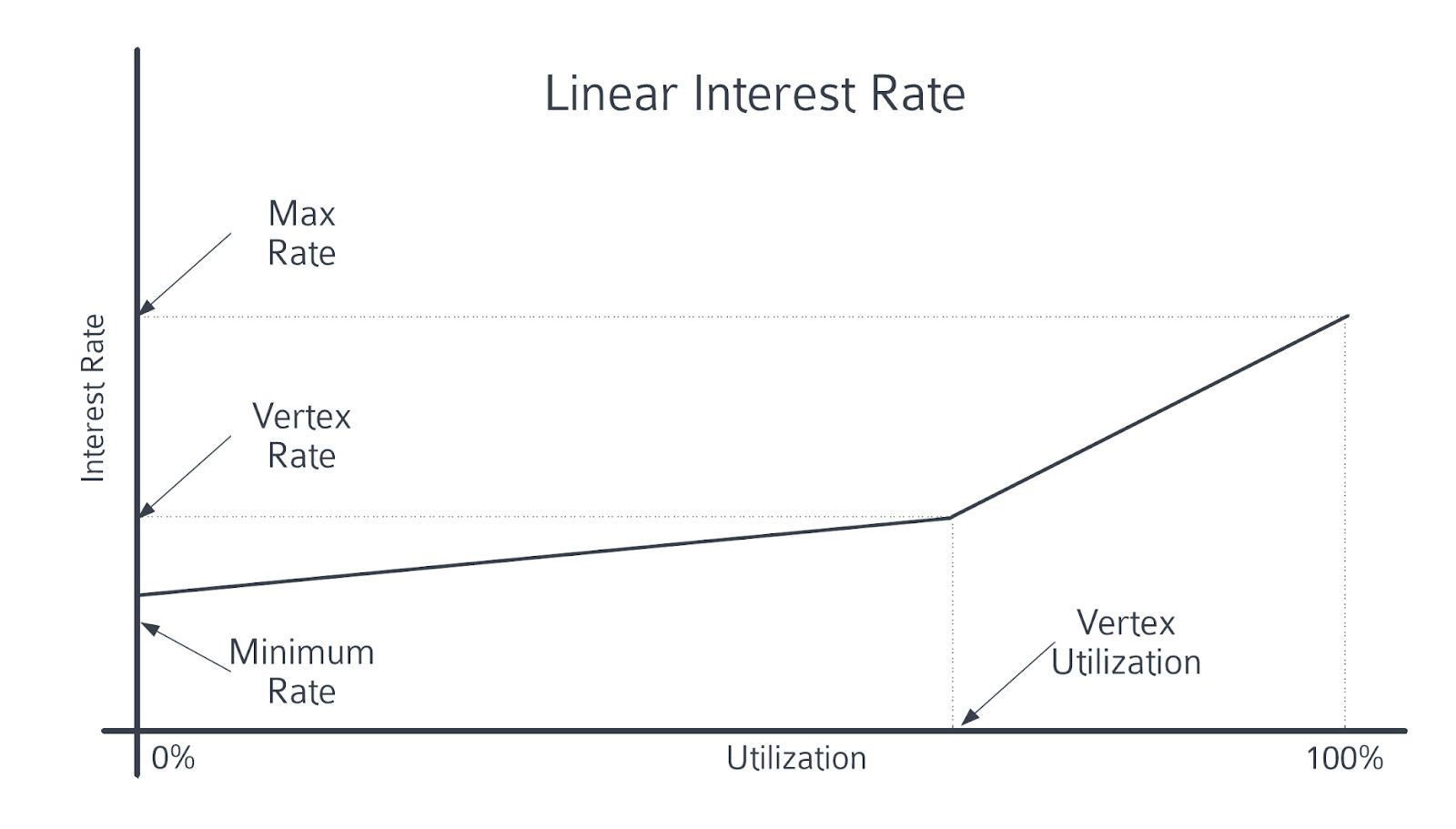

Interest Rate determines the rate that borrowers pay to take debt against their collateral. This rate is set on a pair-by-pair basis, and is immutable and fixed upon deployment. Fraxlend will launch with two rate options: the Linear Rate Calculator and the Time-Weighted Variable Rate Calculator.

The Linear Rate Calculator is the simpler of the two options, raising borrow interest rate linearly as pair utilization rises, and vice-versa.

The Minimum Rate, Vertex Rate, and Max Rates are the three variables for Fraxlend pools set on launch. Minimum Rate is the base interest rate at 0% pool utilization. Between the Minimum Rate and the Vertex Rate, interest rate increases linearly. The increase in slope of the interest rate line between the Vertex Rate (75% utilization, for default permissionless pools) and the Max Rate (100% utilization) to help ensure rates adjust in periods of high demand for pool debt.

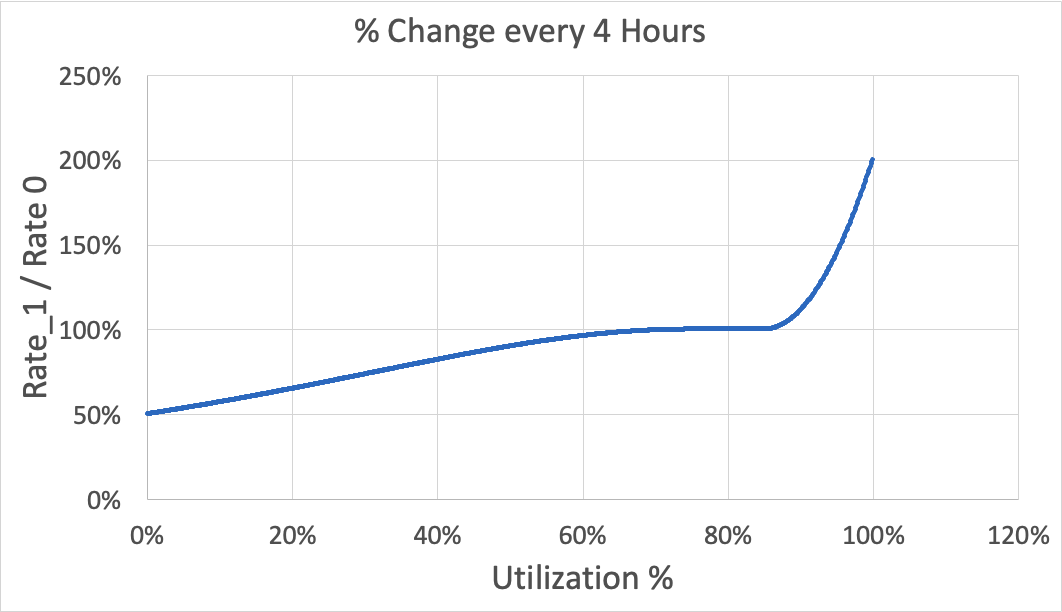

The Time-Weighted Variable Rate Calculator allows the interest rate to float flexibly based on a target ‘healthy’ pool utilization rate and the amount of time that the pool has spent outside of the target range.

Source, The following graph shows how the interest rate changes when the Interest Rate Half-Life is 4 hours, with a Target Utilization Range of 75% - 85%

More importantly, this method allows the market to determine equilibrium rate for a pool - if utilization is below the optimal range for a long enough period, rates will fall to make borrowing attractive once again; if utilization is too aggressive for too long, rates will rise and borrowers will naturally close positions to manage fees.

Implications for Frax

Exploring over-collateralized lending is a critical avenue for Frax to realize its ethos and become the decentralized dollar of DeFi. While perhaps not as aggressive a structure as seen in other lending protocol structures, a siloed and over-collateralized model fits perfectly into the team's historic vision.

This method checks both of the key boxes of growth for Frax- grow total FRAX in circulation, but not at the expense of managing risk and running a clean balance sheet. From a fundamental perspective, the aim of a decentralized stable should also be to grow organically, through uptake in the roots of DeFi. Classically, this was achieved through FRAX’s use as a base-pair on major liquidity platforms like Curve. Now, this can also be achieved by serving as DeFi’s banker.

One of the most under-the-radar notes in the Fraxlend docs describes the opportunity for under-collateralized loans, meaning an LTV > 100%. This upgrade must also be paired with a borrower whitelist to mitigate counterparty risk. Through this small change, Frax has positioned itself to become the centerpiece for peer-to-peer permissionless lending.

The current process for permissionless lending is fraught with counterparty risk and unsustainable practices. As seen in the wake of meltdowns like 3AC, the majority of OTC deals occur on good faith and backroom Telegram chats. This creates systemic and centralized risk that is antithetical to crypto.

Now, major counterparties can use Fraxlend based smart-contracts to simultaneously create lending markets for the largest institutions and the smallest retail investor, all built on the same FRAX rails.

The final major differentiating factor for Fraxlend compared even to other siloed and over-collateralized lending protocols is its no fee model. While it may seem unintuitive at first glance, the goal for Frax has never been to necessarily maximize revenue generation in the lending book. Unlike a standalone lending protocol, they don’t have to; if Frax is run profitably at scale, then simply growing the balance sheet sustainably is enough to grow revenues.

Not only does the organic balance sheet growth increase revenues for the platform, it also:

- Increases the use of FRAX as a currency in DeFi

- Increases Decentralization FRAX

- Increases composability of FRAX

- Mitigates net negative rent-seeking behavior

Needless to say, the deployment of Fraxlend is one of the most exciting and pivotal moments for the protocol since its launch.