There is a time-honored tradition in the United States that happens four times a year. Hundreds of thousands of people all take part in bringing in about, and millions more hang on the results. Billions of dollars a year is spent on this tradition, and it's a cornerstone of the American economy. It affects lives, jobs, and the overall sentiment of American business.

Earnings Szn

A literal descent by CFO’s of public companies from their respective mountains, holding in hand 10-Qs and 10-Ks, delivering the truth to the unwashed masses. Crisp audited financial statements open the doors quarterly to the internal activities of the world's largest organizations. Approved by the board of directors, audited, one or two or three, even externally. Filed with relevant regulatory bodies, and reviewed by a legion of governmental and non-governmental actors. The process of packaging and preparing companies books is a gargantuan process.

On release day, it's like Christmas in every season. A cacophony of surprises emerges from the private coffers of public companies. When the time comes, data is released, and the books are opened. In a split second algorithms tear apart every single line, datapoint, and financial entry, trying to glean immediate trade catalysts. Did they beat earnings? Our top line sales down? What about growth expectations for the next quarter? Should we expect layoffs this year? Or is this company destined for the stars?

After market close the numbers and text are released, analysts take their shot, asking questions to the CEO during the public calls. Executives navigate good and bad news, rumors, leaks, and general gossip. Investment bankers probe deeply into mind and motivations of the C suite, hoping to put together their next quarterly outlook. The reports get filed, aggregated into larger narratives and the whole process starts over again with deadlines only a few months away.

Hello Darkness My Old Friend

The amount of time and energy spent packaging and releasing earnings is astronomical. But it's the only way that public investors can discover the inner workings of a company.

Yet, The main issue is that public investors have to wait 3 months between each earnings release. During these down periods, a data blackout occurs where investors can only guess as to the impact of new products and business lines. The investing public spends countless hours trying to peer into the fortune ball of next quarters earnings so they can profit. It’s an information asymmetry that benefits high info funds with access to third party data or congresspersons with inside information.

Earnings could have radical transparency. Imagine if you could see Amazon’s sales second by second. Or have full access to Google and Twitter’s ad revenue. Or see trade orders executed the moment goods are assigned. It would revolutionize how we invest and view companies.

Unfortunately, most of this data can only become digital after laborious fitting of sensors or personal driven event entry. Real world data is not naturally digital. We have to design custom systems to broadcast digital copies. On a large scale it’s time consuming and inefficient.

A Block-By-Block Balance Sheet

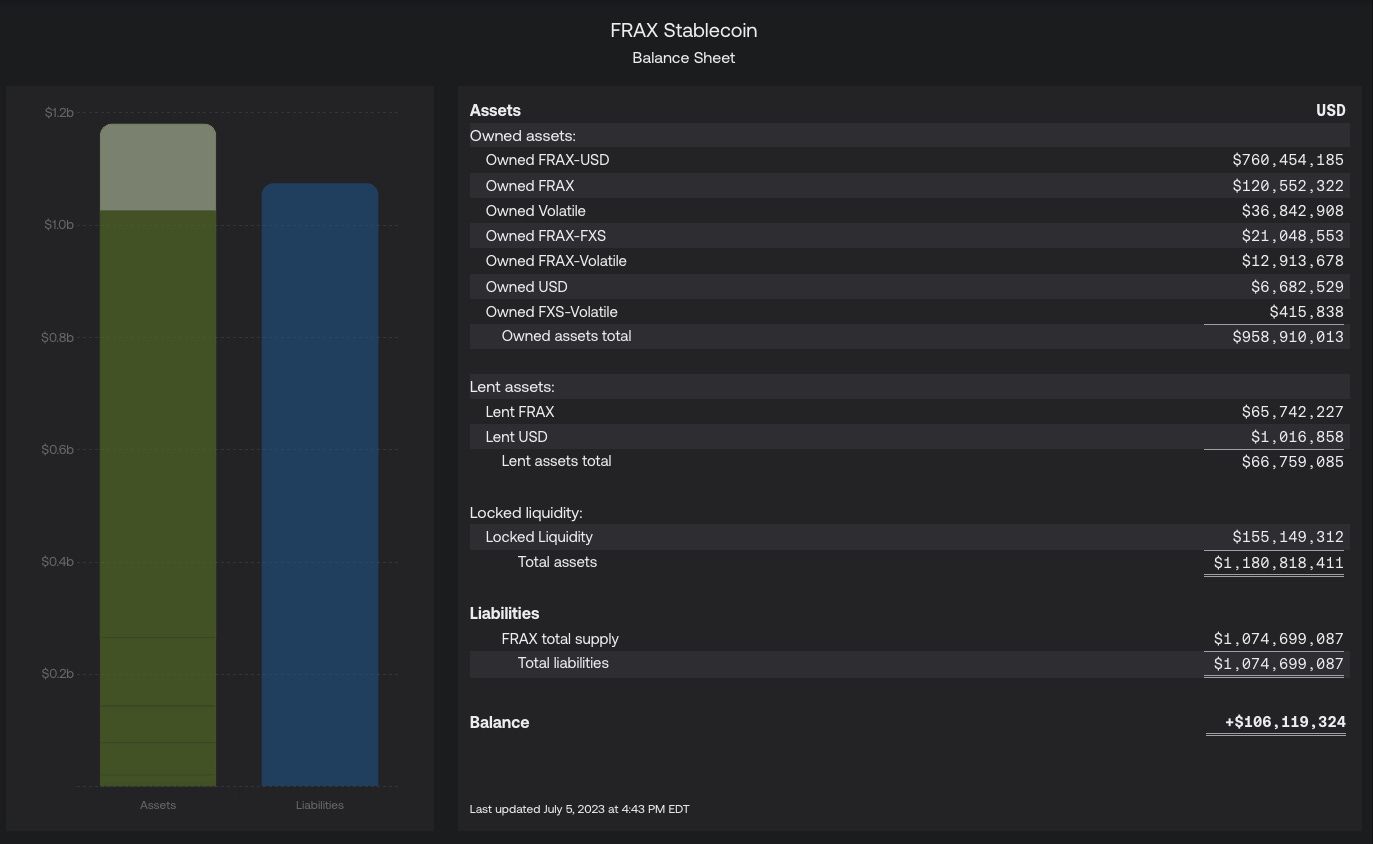

This week, Frax launched the most important analytical dashboard in its entire product suite, a block-by-block live balance sheet. Frax lives on a blockchain which is gifted with radical open transparency as a core characteristic. All of the data is already there, it just needed a developer to package in a readable way.

Now, anyone can get a fresh, live look at the exact composition of all of Frax’s liabilities and assets. It’s the first live public balance sheet for a company in the entire world. No other organization or protocol provides the detail and openness that the Frax balance sheet does.

Instead of waiting for quarterly reports, anyone can now come to the Frax facts page and see the exact makeup and health of the protocol.

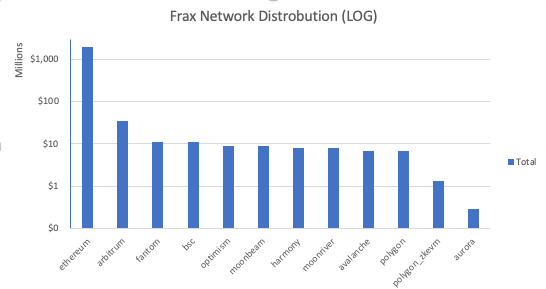

Exploring the balance sheet, the craziest thing that immediately pops out is the lack of distribution across networks. Ethereum is the big daddy and guarantor of Frax’s security and over $2bn Frax is parked there. Arbitrum has the highest amount of Frax outside of ETH with $34m. Just based on these numbers alone, there is significant scope for Frax to expand to other networks.

The largest asset by far is the Owned Frax-USD, which is all the assets deployed in the Curve AMO. This is comprised of FRAX & USDC staked in Frax-Convex FRAXBP, FRAX/USDT/USDC/DAI held within FRAX3CRV LP, and the FRAX/USDP staked in Convex FRAXPP. If you’ve watched any FraxCheck, you already would have known all this though.

The Owned Frax category is all of the Frax that is owned by the protocol, idle Fraxlend AMO funds, and FRAX held in transit by FraxFerry or in its buffer contracts.

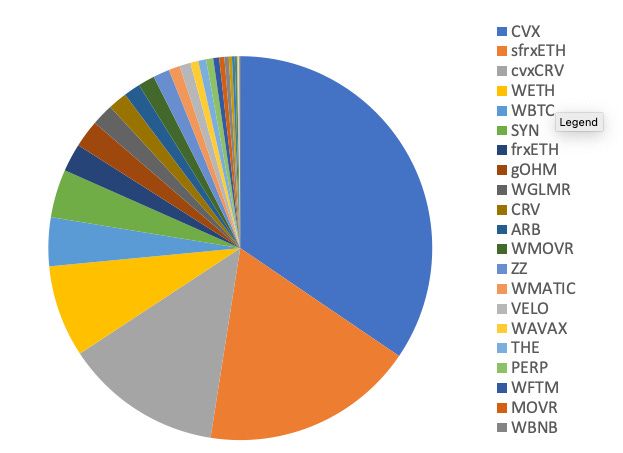

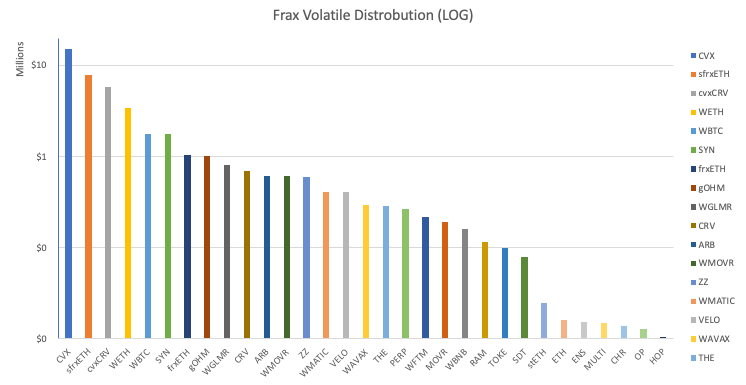

The first surprising part of the balance sheet is the Owned Volatile assets, the Underlying CVX locked in Vote-Locked Convex (vlCVX) and sfrxETH held directly. Frax owns $15m CVX and $7m sfrxETH. Additionally Frax owns $5m in CRV that is staked in Convex.

Digging deeper into the Owned Volatile assets, Frax directly owns gOHM, SYN, ARB, MOVR, ZZ, GLMR, MATIC, VELO, AVAX, THE, PERP, FTM, BNB, SDT, TOKE, ENS, CHR, OP and MULTI. A very robust portfolio of DeFi assets.

Locked liquidity is the CR gap

One of the questions we had when looking at the Balance Sheet was “how do we know what the CR is?” It’s a little confusing at first, but we got an answer from Justin Moore who built the dashboard. He told us that to find the CR, all you do is remove the locked liquidity and divide by total liabilities.

Locked liquidity is all the staked assets that were locked with Frax. They are not counted as collateral, but as an asset. Once the lock is up, they can be removed from the balance sheet once they are withdrawn out of the staking contract. The locked liquidity protects the peg of FRAX as users have committed their assets to the protocol in return for staking rewards.