Recently, Frax Finance announced details about their upcoming frxETH v2 release, a service that permits the permissionless borrowing of ETH validators. As Sam Kazemian talks in his Stablecoin Maximalism speech, all LSDs are just loans, ETH holders lend their assets to a validator who uses it to earn yield.

Lido, Rocketpool and frxETH v2 all allow node operators to borrow ETH for running a validator. The primary differences between the protocols is the loan-to-value ratios.

Flywheel previously wrote about Lido:

All of Lido’s validators are public, centralized, have undergone KYC/AML checks, signed legal contracts with the DAO and have an off-chain relationship with Lido.

Use the loan analogy as a lens, Lido node operators are able to borrow ETH with zero collateral requirements, with the strict assumption that all ETH rewards earned from staking, minus fee, are returned to lenders (stETH holder) as interest through rebasing.

Rocket Pool and Frax are setup for greater decentralization of node operators and so they require collateral to be posted. Without collateral securing the loan, node operators have no incentives to act prudently with the borrowed assets.

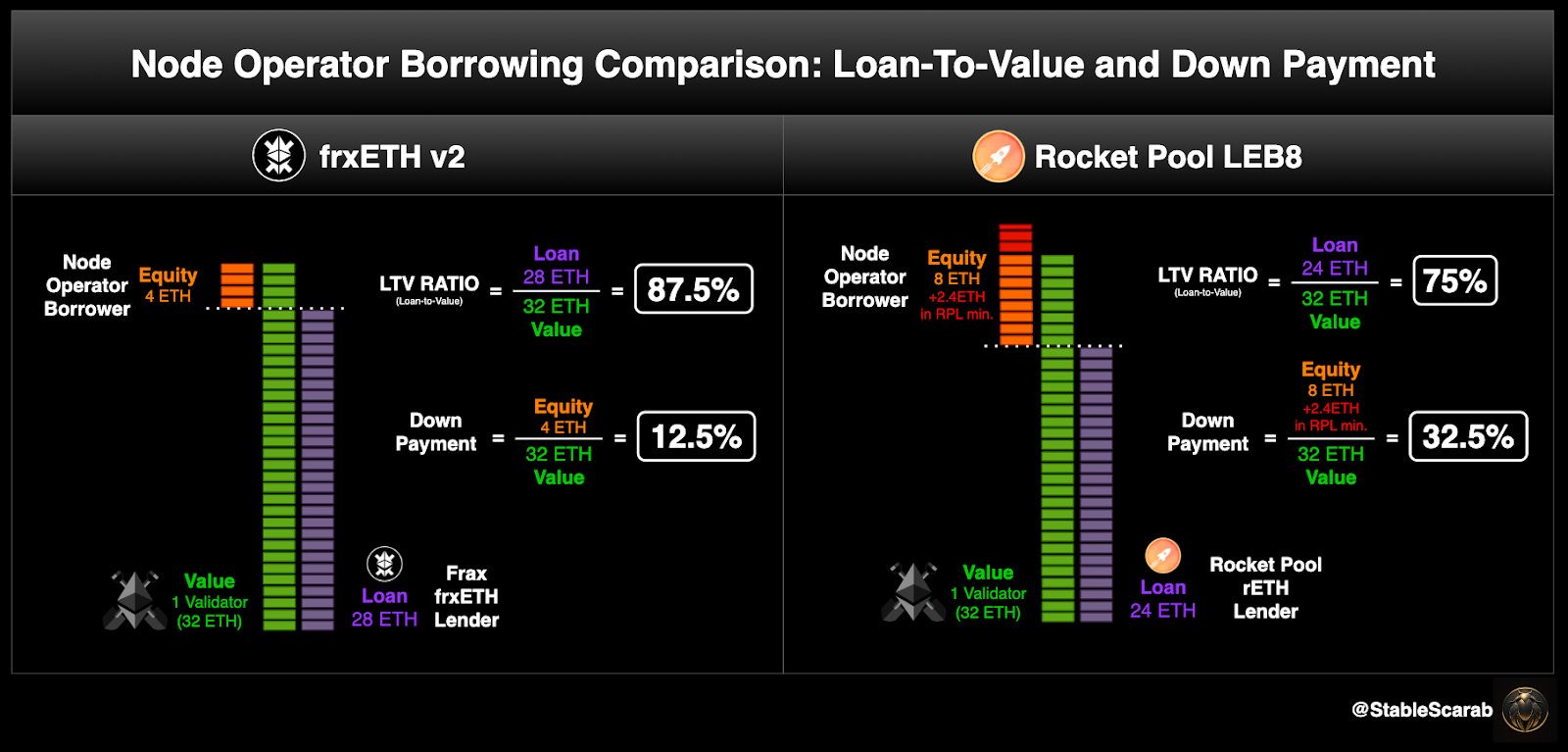

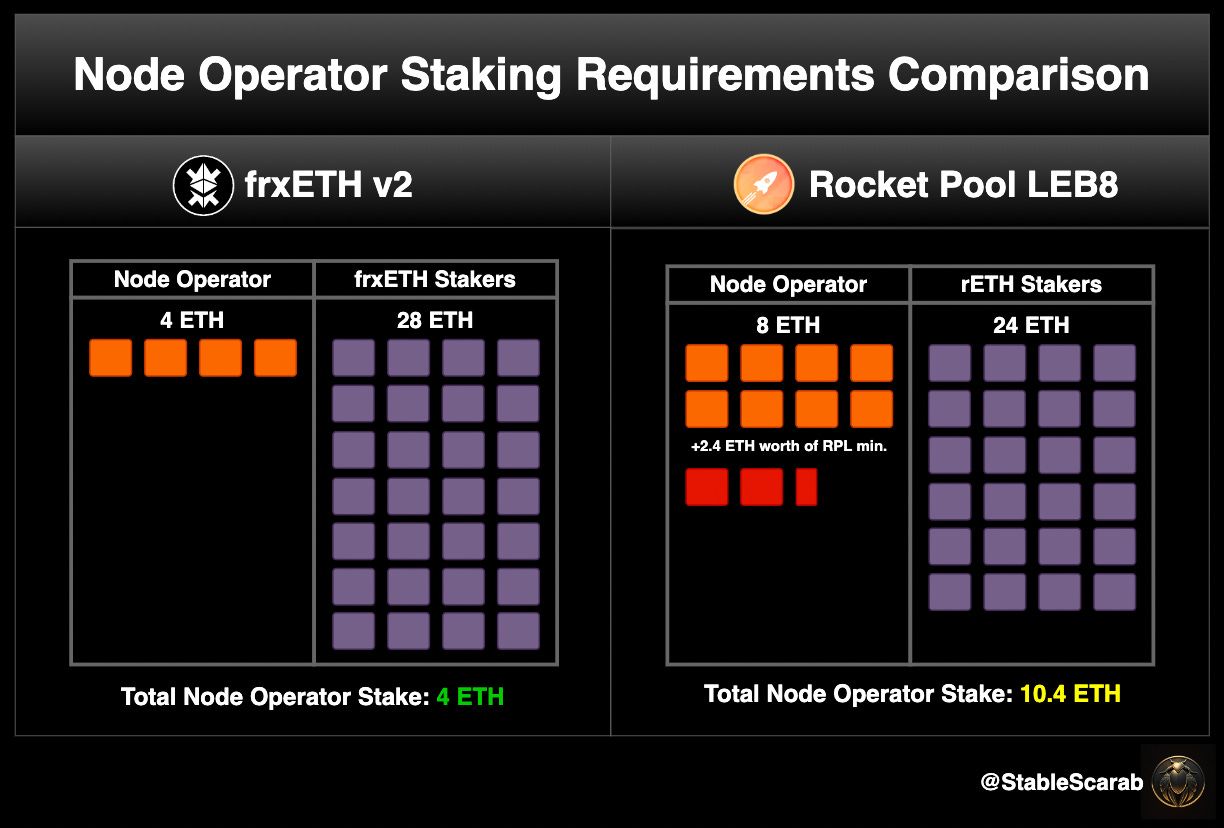

In its upcoming upgrade, frxETH v2 allows node operators to post just 4 ETH collateral, as opposed to Rocket Pool’s 8 ETH and 2.4 ETH worth of RPL “insurance”.

You may wonder, "How can Frax lend out 28ETH for a mere 4ETH collateral?"

In this article, we'll clear the air on how loan-to-value ratios work when borrowing a validator and how frxETH v2 offers higher leverage for node operators without taking on systemic risk.

Borrowing a validator is like mortgaging a home

There is no such thing as a free lunch and when a validator uses frxETH v2 to post 4 ETH collateral, they aren’t getting 28 ETH for free! They have to use the full 32 ETH to run a validator and also a required to pay interest on the full borrow amount. So it’s a common misconception that the Loan-to-Value (LTV) would be the 28 ETH loan divided by the 4 ETH of collateral (thus 700% LTV?!). However, the LTV actually is based on the value of the 32ETH the node operator borrows.

Borrowing ETH using frxETH v2 is more akin to mortgaging a home in this regard.

The loan is the amount that Frax lends to create a 32 ETH validator. So if a node operator uses 4 ETH as collateral, Frax is adding 28ETH to complete the staking setup. Thus, the LTV is 28 ETH divided by the 32 ETH, or 87.5%.

As its designed, frxETH v2 achieves higher LTV ratios and capital efficiency with smaller collateral requirements.

What are the risks?

In 2008, risky loan issuance and high leverage led to the Great Financial Crisis that almost destroyed the banking system. While higher leverage can seem risky, an essential difference is ETH node operators have no asset/debt mismatch.

To illustrate, let's review what happens when a mortgage goes underwater. Imagine putting $250k down to secure a $750k mortgage for buying a $1M house. If the house value drops by $500k and you're unable to keep up with payments, the bank will repossess your home. But the bank, having invested $750k in a house now worth $500k, also incurs a loss. If the housing market crashes globally, you end up with what happened in 2008.

In contrast, when you borrow a ETH for a validator using frxETH, both the loan and the collateral are denominated in ETH. You put up 4 ETH, Frax contributes 28ETH, and you borrow a 32ETH to run a validator. Even if ETH's value plummets by 50%, no entity goes underwater because both collateral and loan was in ETH.

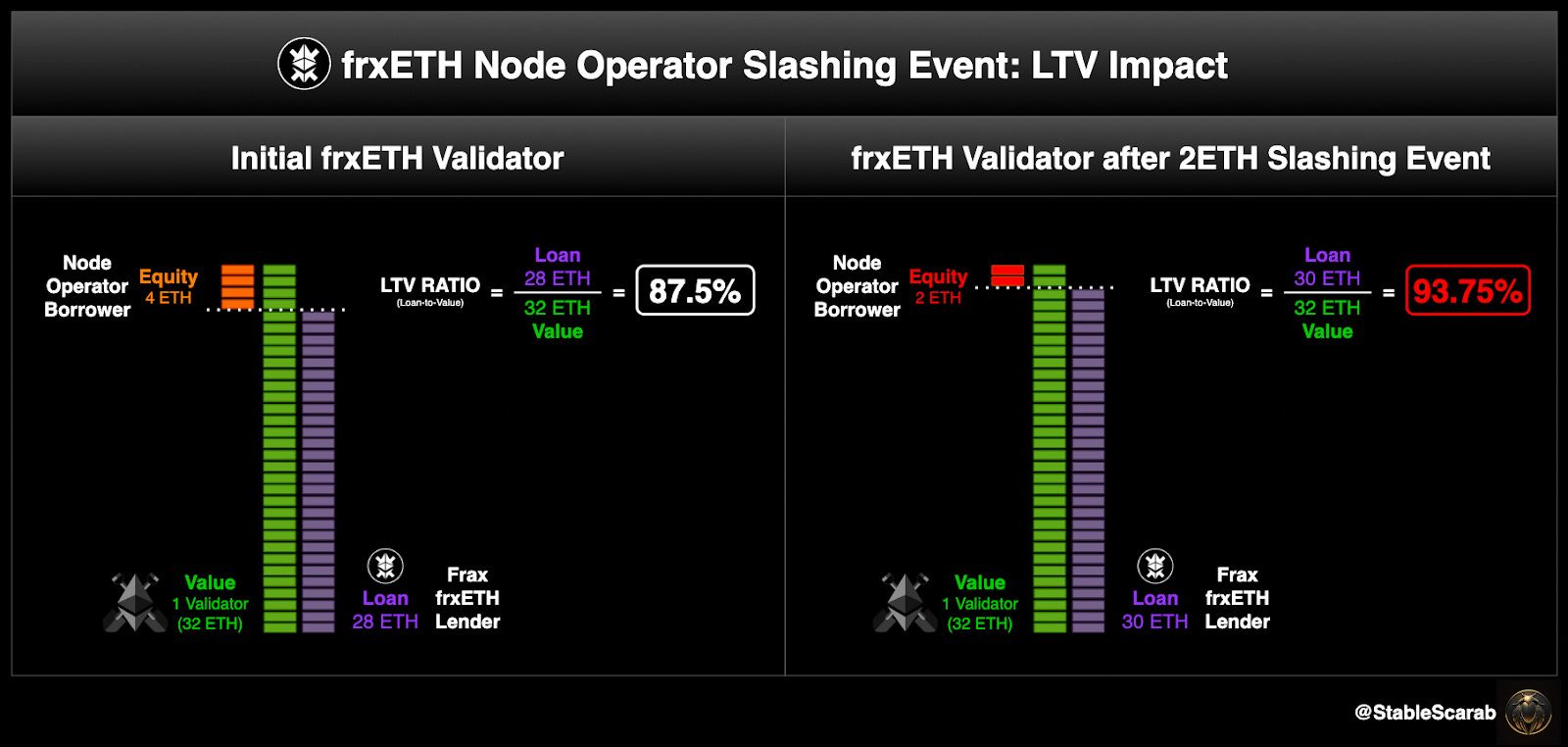

The only way that a node operator can be liquidated is either if they don’t pay back the interest on their loan or if they get slashed and the value of the collateral drops below liquidation thresholds. In either case, Frax simply automatically ejects the validator. And since all validators pre-sign an exit message that withdraws their ETH back to the frxETH v2 contracts, there’s no way a rogue operator could run off with the borrowed assets.

Liquidation thresholds are determined by the LTV ratios. If the initial LTV is 87.5%, then if a node operator gets slashed by 2 ETH, now Frax is providing a loan of 30 ETH instead of 28 ETH for the validator. The new LTV would then be 93.75% (30/32 ETH). At this point, the validator would be ejected by the oracle and the ETH would be returned to the lending contract.

The Frax Advantage

Both the Rocketpool system and frxETH v2 work in similar ways. In both systems, node operators post up collateral and then borrow ETH. While Rocketpool currently requires 8 ETH collateral, they could reduce it to 4 in the future to compete with frxETH

However, the biggest difference is that Rocketpool requires 2.4 ETH worth of RPL to be staked to provide “insurance.” While the staked RPL does increase the collateral buffer, it also reduces the LTV of their lending system. This is a core function of their ecosystem and we doubt that it would be removed, otherwise, what would the token be good for other than as a governance token?

While frxETH might just look like Rocketpool without RPL requirements, this is an unintelligent take. frxETH v2 codifies all ETH staking as lending and establishes a dynamic market as its core function.

The variable interest rate charged by Frax probably won’t be equal to the staking rate, in fact, it most likely will be higher! With all the new ways to earn income as a validator (MEV, restaking, DappNets), node operators might have insatiable demand for staked ETH.

The top-performing node operators have the most to gain.

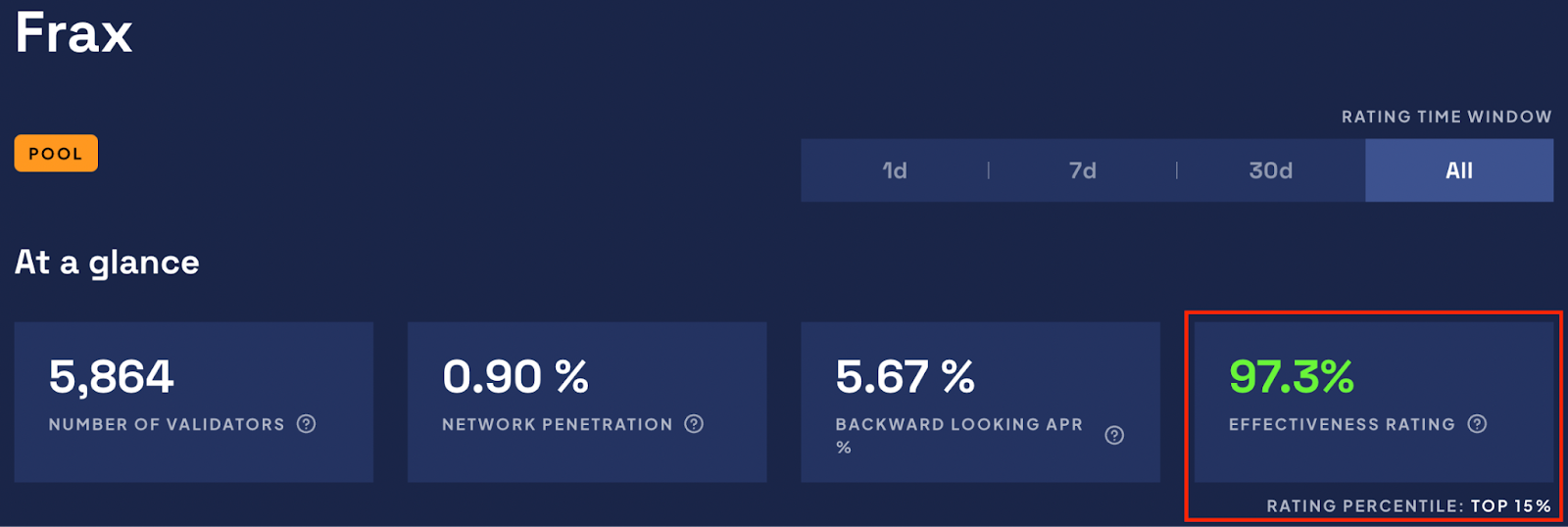

In frxETH v1, Frax managed all the validators and had the highest effectiveness rating among all Ethereum validator pools. By incentivizing performance with frxETH v2, Frax decentralize its validator set while still maintaining a best-in-class APR.

A portion of the rewards, currently 10% in frxETH v1, continues to go to veFXS holders and insurance. With step change improvements in LSD system architecture, frxETH v2 is once again showing how Frax is a leader in DeFi innovation and increasing the monetary premium of their stablecoins.